Bitcoin 101: Part III

Bitcoin as Monetary Good & Investment, Self-Custody, and Answering Bitcoin Critiques

Bitcoin as a Monetary Good

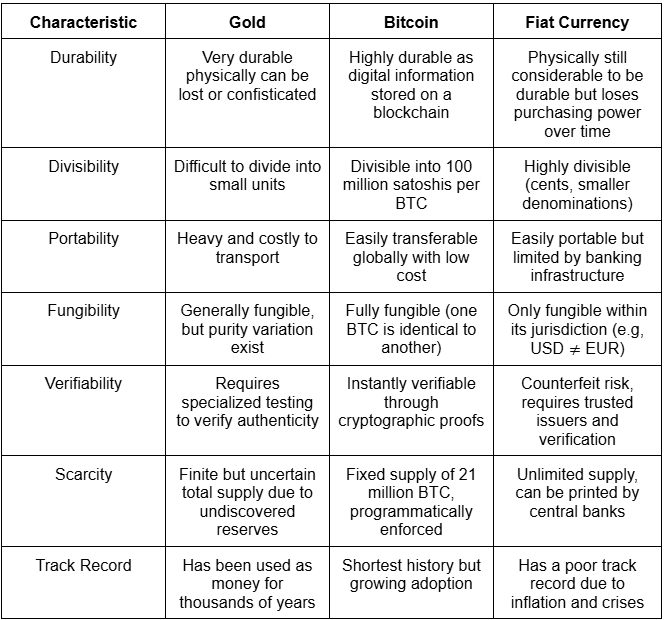

Bitcoin is considered a monetary good because it possesses the key characteristics that define sound money – durability, divisibility, portability, fungibility, verifiability, scarcity, and a historical track record. Unlike commodities that are valued for their intrinsic utility, monetary goods derive value primarily from their ability to facilitate exchange and store wealth over time. The table below highlights how Bitcoin compares to gold and fiat in key monetary attributes:

Bitcoin as an Investment

Many people are initially antagonistic toward Bitcoin due to its high volatility, viewing it as too risky compared to traditional assets like gold or stocks. However, in the world of investing, volatility is not the enemy—it is a powerful ally for those who know how to leverage it. Volatility creates opportunities for extraordinary growth, as demonstrated by Bitcoin’s Compound Annual Growth Rate (CAGR) above, which has consistently outperformed other assets. This data further cements Bitcoin’s status as the best-performing financial asset in history.

Bitcoin is known for its high returns over multiple years, but it is also highly volatile. This raises the question: Are Bitcoin's high returns justified given the risk involved? The Sharpe ratio helps answer this by showing whether BTC's returns sufficiently compensate for its volatility compared to other asset classes. The chart reveals that, despite its volatility, Bitcoin often outperforms other assets in risk-adjusted terms, especially over longer holding periods. Historically, Bitcoin has maintained a higher Sharpe ratio than most traditional investments over multi-year timeframes, suggesting that its returns have generally been worth the risk.

Becoming a Good Bitcoiner : Self Custody

One of the unique characteristics of Bitcoin that no other asset possesses is total ownership, full control over one’s funds without relying on intermediaries. Unlike money in a bank or stocks held by a brokerage , which can be frozen or seized, Bitcoin allows it owners to have complete control over their assets. However, many people overlook this aspect because they store their Bitcoin on exchange, which only provide access to a balance, not true ownership. This means that if the exchange is hacked, shut down, or decides to freeze wirthdrawals, users can lose access to their Bitcoin. That’s why self-custody is essential.

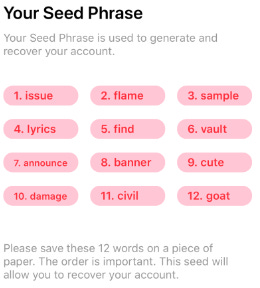

A Bitcoin wallet is a tool for self-custody that manages the private keys needed to control and access Bitcoin on the blockchain. It does not store actual Bitcoin but instead hold cryptographic keys that prove ownership. The most critical component of a wallet is the seed phrase, also known as recovery phrase. Seed phrase is a sequence of 12 to 24 words that acts as a backup for all private keys associated with the wallet. The seed phrase is generated from a pre-defined list of 2048 English words, known as the BIP-39 word list. Each word in the list is carefully chosen to avoid confusion (e.g, similar-sounding words are excluded) and to ensure compatibility across different wallets. The seed phrase is the most important part of Bitcoin self-custody because it provides a way to recover funds if a wallet is lost, deleted, or even if the hardware is damaged. As long as the seed phrase is safely stored, users can restore their Bitcoin on any compatible wallet, ensuring that they never lose access to their funds.

There are several types of wallet, each offering different levels of security and convenience.

Hot Wallets (Connected to the internet)

Hot wallets are convenient for frequent transaction but are more vulnerable to hacking since they are always online. Examples of hot wallets:

Mobile Wallets → TrustWallet, BlueWallet, Muun, Mycelium

Desktop Wallets → Electrum, Wasabi Wallet, Exodus, Atomic Wallet

Cold Wallets (Offline & More Secure)

Cold wallets is a type of Bitcoin wallet that keeps private keys completely offline, making it significantly more secure against hacking and unauthorized access. Examples of cold wallets:

Hardware Wallets

Hardware wallets are physical devices designed to store private keys while allowing users to sign transaction safely. Here’s how they work:

The wallet connects via USB or Bluetooth to a computer or smartphone only when signing transactions.

The private key never leaves the device, meaning even if the connected device is infected with malware, the private key remains safe.

Some advanced hardware wallets also support passphrase encryption for additional security.

There are some examples of hardware wallets such as Ledger Nano S/X, Trezor One/Model T.

Air-gapped Wallets

Air-gapped wallets are completely offline devices used for signing Bitcoin transactions. Unlike hardware wallets, which connect via USB or Bluetooth, air-gapped wallets never connect to any network or online device, making them even more resistant to hacking. Here’s how they work:

Transactions are created on an online device (computer or phone) and then transferred to the air-gapped wallet via QR codes, or SD cards.

The wallet signs the transaction offline, ensuring that the private key is never exposed to an online environment.

The signed transaction is then transferred back to an online device for broadcasting to the Bitcoin network.

There are some examples of air-gapped wallets such as Coldcard, Keystone, Seedsigner.

After choosing the right wallet for self-custody, the next crucial step is securing your seed phrase properly. No matter how secure your wallet is, if your seed phrase is lost, stolen, or exposed to unauthorized access, you risk losing all your Bitcoin permanently. The best way to store a seed phrase is offline to prevent exposure to hacks, malware, or phishing attacks. Writing it down on paper is a common method, but paper can be easily damaged by water, fire, or physical wear. A more durable option is to use metal backups, which are resistant to fire, water, and corrosion, ensuring long-term protection of your Bitcoin recovery phrase. Below are some examples of metal backup solutions:

Answers to Bitcoin Critiques

Bitcoin receives a lot of criticism—some valid, some based on misunderstandings. Here, we list the most common criticisms of Bitcoin along with clear explanations to address each one.

Bitcoin Has No Intrinsic Value

Some people argue that Bitcoin has no intrinsic value because it is purely digital and not backed by any physical asset. However, the idea of intrinsic value itself is misleading. Nothing has value on its own—people assign value to things based on their usefulness and demand. For example, gold is highly valued not just because of its industrial use, but because of its scarcity, durability, and ability to store wealth over time.

Bitcoin shares many of the same qualities as gold but improves on them due to its digital nature. Like gold, Bitcoin is scarce, fungible, and durable, making it a strong store of value. However, Bitcoin also has unique advantages that physical assets cannot match—it is easily transferable, highly secure, and decentralized, meaning no government or central authority can control it. Because of these superior properties, Bitcoin is often referred to as "digital gold", a modern alternative to traditional stores of value.

Bitcoin Wastes Energy

Some people claim that Bitcoin mining is extremely energy-intensive and therefore wasteful. However, Bitcoin’s energy use is not random or unnecessary—it serves three essential functions:

Ensuring fair distribution of new Bitcoin according to its monetary policy.

Allowing anyone to participate in securing the network without relying on a central authority.

Providing strong security that makes Bitcoin’s transaction settlement resistant to manipulation.

It’s also important to remember that every financial system requires energy to function. Gold mining consumes massive amounts of energy to extract, refine, and securely store gold. Traditional banking systems require an extensive infrastructure of physical bank branches, office buildings, data centers, and security systems, all of which consume large amounts of energy. These costs are not usually measured in energy terms, but if they were, they would be significantly high.

Bitcoin, in contrast, bundles monetary creation, transaction processing, and security into a single energy-intensive process called mining. This process, known as Proof of Work, ensures that Bitcoin’s transaction history cannot be altered, making it the most secure decentralized financial system in existence. Given Bitcoin’s hundreds of billions of dollars in market value and billions of dollars settled daily, the energy used to secure the network is demand-driven, not wasteful.

Bitcoin is Used by Criminals

Some argue that Bitcoin is mainly used by criminals for activities like drug dealing and money laundering, making it a dangerous financial tool. This perception comes largely from early dark web marketplaces like Silk Road, which used Bitcoin as a payment method. However, in reality, illicit activity has always been a small fraction of total Bitcoin transactions—currently estimated to be less than 1%. In fact, a report by former CIA Acting Director Michael Morell found that Bitcoin’s role in criminal activity is greatly overstated and that traditional banking systems facilitate far more illicit transactions than Bitcoin does relative to global GDP.

New technologies often attract early criminal use before the wider public recognizes their legitimate value. Bitcoin's censorship resistance initially made it useful for illicit activity, but this same property is also what makes Bitcoin a secure and efficient financial network without the need for middlemen. Unlike traditional payment systems, Bitcoin eliminates many forms of fraud, such as credit card chargebacks, identity theft, and merchant payment fraud. In contrast, legacy financial systems rely on costly fraud protection mechanisms, such as Visa and Mastercard charging merchants ~3% per transaction to cover fraud losses.

Bitcoin Can Be Cloned

Some people worry that a new cryptocurrency could replace Bitcoin or that Satoshi Nakamoto (Bitcoin’s creator) could launch another version, making Bitcoin obsolete. Others point out that since thousands of cryptocurrencies exist today, Bitcoin isn’t truly scarce and therefore cannot be valuable.

However, while cryptocurrencies in general are not scarce, Bitcoin itself is. Anyone can clone Bitcoin’s open-source code and create a new cryptocurrency, but they cannot replicate Bitcoin’s security, network adoption, and brand recognition. People have been cloning Bitcoin since 2011, yet no clone has come close to matching Bitcoin’s market cap or adoption.

Bitcoin benefits from extremely strong network effects—millions of users, businesses, and institutional investors have already built on and around the Bitcoin ecosystem. This creates a lock-in effect, similar to how foundational internet technologies like TCP/IP (for data transfer) and SMTP (for email) have remained dominant for decades, despite the emergence of newer alternatives. Once a technology reaches mass adoption, it becomes nearly impossible to replace.

Bitcoin is a Bubble

Some critics compare Bitcoin to the Dutch tulip mania of the 1600s, claiming that it is a speculative bubble driven by retail hype and will eventually collapse. However, this comparison misunderstands both Bitcoin and the actual tulip bubble. The tulip bubble was a short-lived, one-time event that lasted only a few months and involved a small number of people. In contrast, Bitcoin has been growing for over a decade, experiencing multiple boom-and-bust cycles where its price surged by over 1000%, followed by corrections of 80% or more. Yet, after each crash, Bitcoin has always recovered to new all-time highs, showing sustained long-term growth rather than a temporary mania.

Another argument against Bitcoin is that it has no cash flow, unlike bonds that pay interest or stocks that generate profits. However, this is the same flawed thinking as the "no intrinsic value" argument. People assign value to assets based on demand and usefulness, not just cash flow. Gold, for example, has been a store of value for thousands of years, despite not generating income. Similarly, Bitcoin is valued for its scarcity, security, decentralization, and ability to function as digital money. Far from being a short-term bubble, Bitcoin's adoption and price growth follow the patterns of an emerging technology or network effect, similar to dominant tech companies like Amazon or the internet itself.

Bitcoin Fails as a Currency

Some argue that Bitcoin cannot function as a proper currency because it is too volatile, transactions take too long to settle, and fees can be high. While it's true that Bitcoin is not currently optimized for day-to-day transactions, that does not mean it is a failure. In fact, Bitcoin settles billions of dollars in transactions every day, proving its role as a functioning financial system.

Gold, for example, is a poor medium of exchange—it is heavy, impractical for payments, and slow to verify—yet it holds over $10 trillion in value because of its role as a store of value. Bitcoin operates in a similar way, providing an alternative to gold in the digital space. Additionally, because Bitcoin is programmable and digital, scalability solutions like Lightning Network can be built on top of Bitcoin, enabling instant and low-cost global payments without affecting its base layer security.

Bitcoin Gets Hacked

Many people believe Bitcoin is not secure because they frequently hear news reports about Bitcoin being hacked. However, these reports do not refer to Bitcoin itself, but rather to centralized platforms and services that store Bitcoin—such as exchanges and custodians—that have been compromised.

For example, the most infamous case was the Mt. Gox hack, where a Bitcoin exchange lost 650,000 BTC ($362 million at the time) due to security flaws in its system. This is similar to a bank or stockbroker getting hacked—it does not mean the US dollar or stock market itself is insecure, just that a particular financial institution failed to protect its assets.

Bitcoin as a protocol is decentralized, open-source, and secured by thousands of nodes and miners worldwide. It has never been hacked, and its codebase is among the most scrutinized and secure in the world. Unlike centralized systems, Bitcoin does not have a single point of failure, making it highly resistant to attacks that typically affect banks, payment processors, or exchanges.

Bitcoin Is Vulnerable to a 51% Attack

Some critics argue that Bitcoin is at risk of a 51% attack, where a single entity gains control of more than 50% of the network’s mining power and can manipulate transactions. While this scenario is theoretically possible, it is important to understand the limitations and consequences of such an attack.

First, a 51% attack does not mean full control over Bitcoin. An attacker with majority mining power could temporarily disrupt transactions by censoring or reorganizing blocks, but they could not steal funds, alter past transactions, or change Bitcoin’s monetary policy. Bitcoin’s security is based on decentralization and economic incentives, and a 51% attack would be extremely costly, making it an impractical long-term strategy.

Additionally, Bitcoin’s mining ecosystem is highly dynamic. Mining power is distributed across many independent miners who can easily switch mining pools if a single entity starts approaching 51% of the hash rate. Historically, when mining pools have come close to this threshold (e.g., in 2011, 2013, and 2014), miners voluntarily moved to other pools to prevent any single entity from gaining too much control.

Finally, if a large-scale 51% attack did occur, the Bitcoin community could respond with a hard fork—a software update that would make the attack ineffective and render previous mining equipment obsolete. This risk discourages any miner from attempting such an attack, as it could lead to massive financial losses rather than long-term control.

Overall, while a 51% attack is theoretically possible, it is highly unlikely due to the economic incentives, decentralized mining structure, and defensive mechanisms available to the Bitcoin network.

Closure

Bitcoin is not just another volatile cryptocurrency—it is a technological breakthrough that combines cryptography, decentralized networking, and game theory to create a trustless, censorship-resistant monetary system. More than just digital money, Bitcoin represents a revolution in financial sovereignty, allowing individuals to hold and transfer value without reliance on banks or governments. It is a system that operates purely on mathematical rules, immune to manipulation, inflation, or political intervention.

For over a decade, Bitcoin has survived regulatory pressure, attacks, and skepticism, emerging stronger after every challenge. It has transitioned from an experimental idea into a global financial asset, recognized not only by retail investors but also by institutions, hedge funds, and even governments. The rise of Bitcoin ETFs, corporate treasuries adopting Bitcoin, and discussions of national reserves all signal one thing—Bitcoin is here to stay.

We are still in the early stages of Bitcoin’s journey. What was once dismissed as a niche experiment has now redefined the concept of money itself. The question is no longer "Will Bitcoin survive?" but rather "How far will Bitcoin go?" Like the internet before it, Bitcoin is an unstoppable force—one that is too big to ignore and too important to dismiss. The future belongs to those who understand it, adopt it, and embrace the financial revolution it brings.