After three straight months of declines from February to April —driven by tariff concerns and geopolitical uncertainty— markets staged a sharp rebound in May. The S&P 500 climbed 6.3%, bringing the index back into positive territory for the year at +1.1% YTD, including dividends.

The rally was supported by strong tech earnings, easing inflation pressures, and renewed optimism around potential trade deals. Still, investor sentiment remains fragile, with fiscal instability and unresolved trade tensions continuing to cloud the outlook.

Since our Unpopular Opinion article and our podcast with NAAIM, and later as we reiterated in It's Time article, the U.S. stock market has rallied +13% from its recent bottom, validating our view that pessimism had overshot fundamentals.

The OBBBA concerns

In 2024, Americans rallied behind a demand for leaner government, fed up with bloated spending and bureaucratic waste. That frustration gave rise to DOGE, a movement backed by figures like Elon Musk and Vivek Ramaswamy, aiming to slash waste in federal government spending and restore fiscal conservatism, rooted in the classical liberal tradition. The initiative later gained formal traction through a presidential executive order.

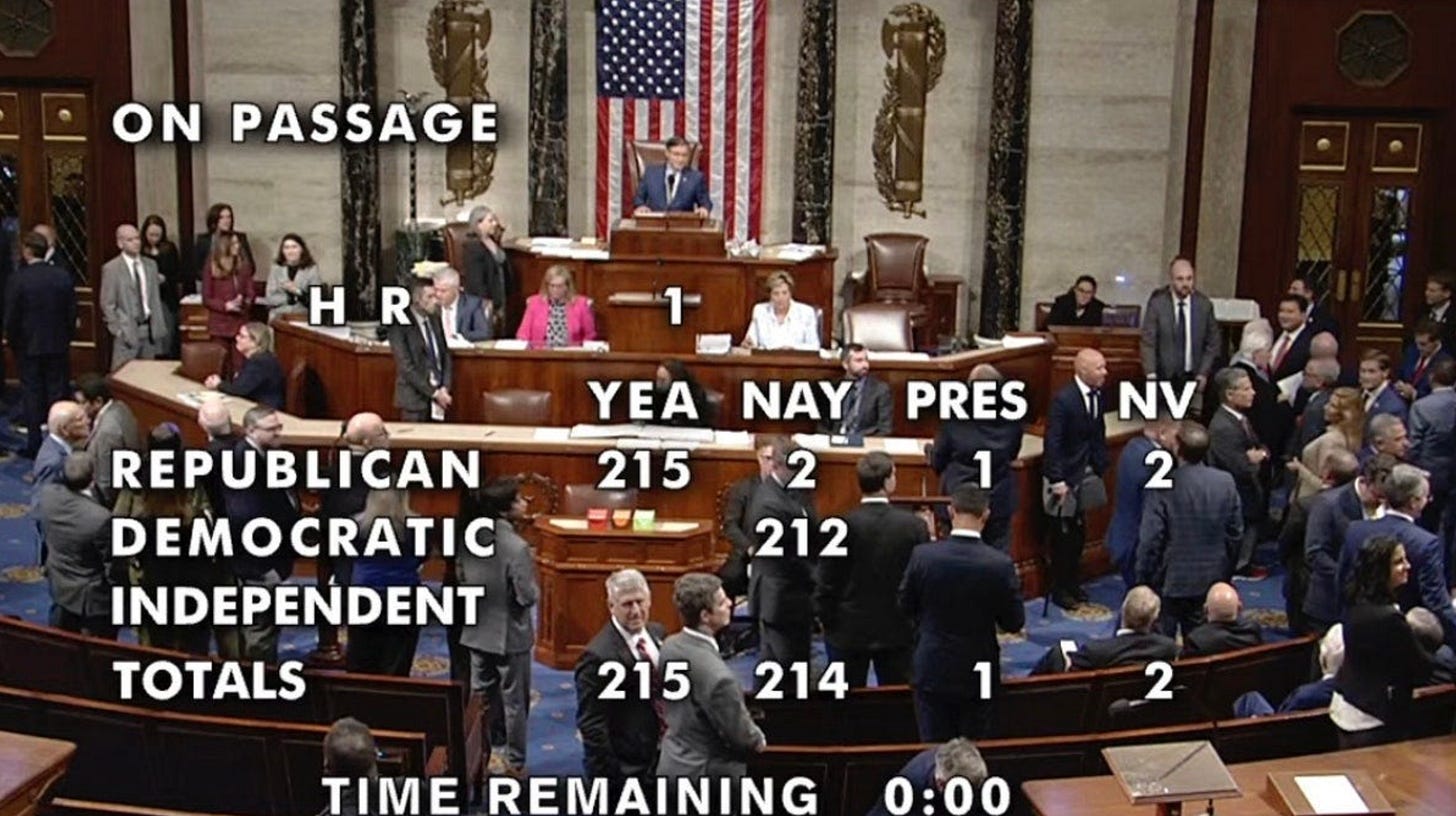

Against that backdrop, the One Big Beautiful Bill Act (OBBBA, H.R. 1), narrowly passed by the House of Representative on May 22, 2025 (215–214), was billed as a response. It aligns with President Trump’s priorities: tax cuts, border security, defense, and energy independence. But for many fiscal-conservative Republicans, the bill doesn’t go far enough.

Critics, including Senators Ron Johnson (R-WI) and Rand Paul (R-KY), warn OBBBA could add $3.3 to $5 trillion in new debt over the next decade. Its $1.5 trillion in proposed spending cuts, mostly from Medicaid and SNAP, amount to just 1.68% of the $89.3 trillion in projected federal spending through 2035. For those pushing a return to pre-pandemic spending levels, that’s a drop in the bucket.

The bill also includes a $4 trillion debt ceiling increase and preserves clean energy subsidies, which fiscal-conservative Republicans view as fiscally reckless. The House Budget Committee initially rejected the bill, with both Democrats and fiscal-conservative Republicans opposing it. A slightly revised version narrowly passed days later.

Now in the Senate, OBBBA faces an uphill battle despite a Republican majority. fiscal-conservative Republicans senators demand deeper spending cuts, while moderate Republicans oppose rolling back green energy credits. At least five Republicans have voiced concerns, making amendments likely.

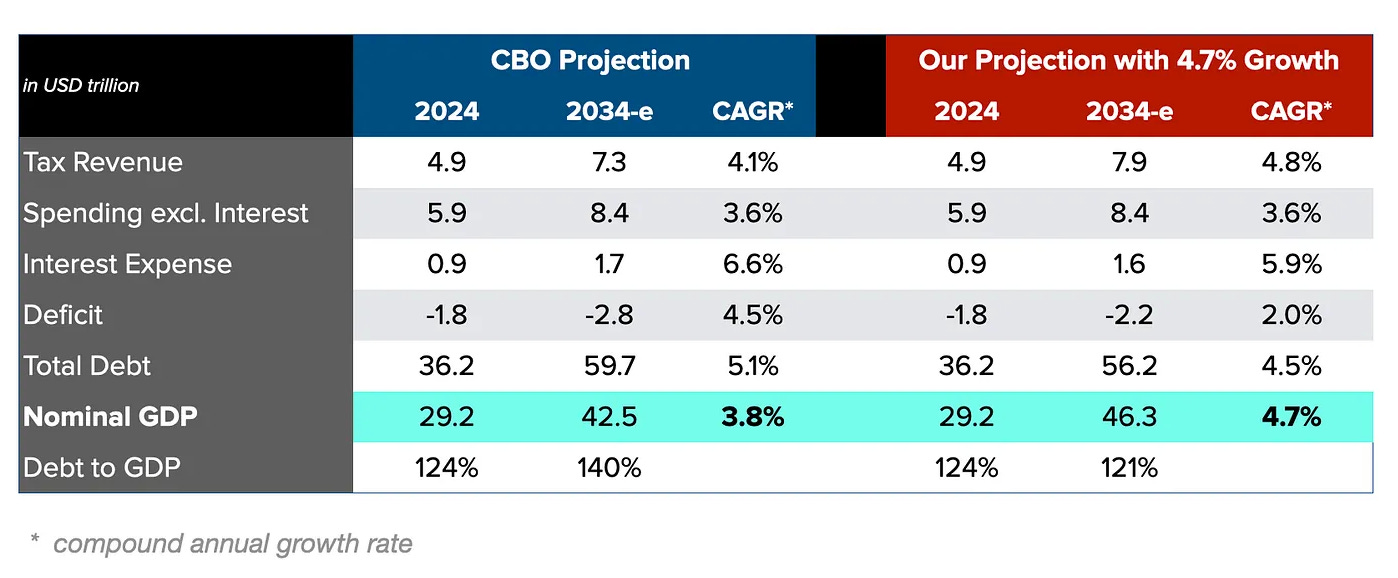

Supporters argue the bill will pay off. House Speaker Mike Johnson claims it could lift GDP by 5.2% over four years, translating to $13,300 in additional take-home pay per family. However, independent forecasts are more cautious. The Tax Foundation projects a more modest 0.8% GDP boost, along with a $4.1 trillion revenue shortfall by 2034. Meanwhile, the Congressional Budget Office (CBO) expects no meaningful change in nominal GDP growth from the tax cuts, implying weaker revenue gains and higher deficits over the long run.

Markets have already shown concern. A credit downgrade by Moody’s signaled growing unease, following a similar move by Fitch in 2023. Without stronger growth or bolder reforms, OBBBA risks becoming less a solution, and more a signal of fiscal drift — one that could eventually trigger higher borrowing cost and financial market volatility.

A brighter scenario for OBBBA

While many remain skeptical of OBBBA’s fiscal outlook, stronger-than-expected growth could still shift the narrative.

Our internal projections suggest that IF nominal GDP grows at 4.7% annually (significantly above the base case projection of Congressional Budget Office, the CBO) and federal tax receipts come in stronger than expected, the long-term deficit picture could improve meaningfully. In this high-growth scenario, tax revenues would rebound more rapidly despite OBBBA’s tax cuts, helping narrow the deficit and stabilize the debt-to-GDP ratio by 2034.

One potential driver of such economic growth could be: substantial investment inflows, particularly from capital-rich Gulf states following Trump’s successful visits, as well as increased interests from other foreign investors. Another is deregulation, including reforms to agencies like the Nuclear Regulatory Commission, which could unlock capital and accelerate key sectors.

What comes next?

In the meantime, we can only hope for greater government efficiency, and that Congress will ultimately codify the DOGE cuts to provide lasting fiscal legitimacy. Elon Musk has stepped down from his role as an unpaid special government advisor, but President Trump remarked, “Elon will always be with us, helping all the way.”

Looking ahead, there is cautious optimism that the Senate’s amendment process on OBBBA could enhance the bill’s fiscal trajectory and help restore broader confidence in its purpose.

As the 30th U.S. President once said:

“It is much more important to kill bad bills than to pass good ones.”

— Calvin Coolidge

Thanks for reading!

This post first appeared on christmascorp.substack.com.

For more timely updates and new writing, you’re welcome to subscribe there.

Disclaimer:

“Christmas Corp Side Notes” is provided for informational and educational purposes only. Nothing contained in this publication should be considered as investment advice, recommendations, or guarantees of future performance. While we strive for accuracy, Christmas Corp makes no warranties regarding the reliability or completeness of the information. Investing in financial markets carries risk, including potential loss of principal. Readers should conduct their own due diligence and seek professional financial guidance before making investment decisions. Christmas Corp and its affiliates assume no liability for any losses arising from the use of this content.