Drill Baby Drill! A Closer Look To The US Energy Sectors

Introduction: Investing Amid Policy Shifts

In the ever-evolving landscape of global energy and geopolitics, policy shifts can dramatically reshape investment narratives. One such transformative pivot emerged from the executive branch of the United States under former President Donald J. Trump. Through a series of bold executive orders (EOs), Trump sought to reposition the U.S. energy sector—moving away from clean energy acceleration and toward the revitalization of traditional energy dominance.

These executive actions, particularly in the later years of his presidency and echoed in recent Republican policy drafts, represent more than mere bureaucratic shifts. They signal a fundamental change in how investors must perceive opportunity, risk, and sector rotation. For intermediate-level investors, the implications are profound: from LNG exporters to oil drillers in Alaska, and from uranium mining to pipeline infrastructure, the chessboard has been reset.

This article explores how investors can respond tactically and strategically to these executive orders. By understanding the economic rationale, market impact, and sector-specific outlook, investors can craft portfolios that are resilient, opportunistic, and aligned with shifting regulatory winds.

Drill Baby Drill

Baby, baby, baby, drilllll! -Not Justin Bieber

If Justin Bieber’s “Baby” was sent to the Moon, then Donald Trump’s “Baby” is being launched straight to Jupiter.

During his presidency, Trump signed a flurry of Executive Orders at breakneck speed, many of them zeroing in on a critical theme: energy security. And this wasn’t without good reason. A quick glance at America’s Strategic Petroleum Reserve reveals a concerning fact — it had dropped to levels not seen in nearly 50 years.

Today, the United States stands as the largest oil producer in the world. But it’s also the largest consumer — and still heavily reliant on imports. Energy security means having the ability to meet domestic energy needs independently, without having to rely on foreign suppliers who might not always be friendly.

One key indicator often cited when discussing U.S. energy strength is the Baker Hughes Oil Rig Count — a real-time pulse on drilling activity. Since the last great commodity boom in 2013, the number of active rigs has been steadily declining. In other words, the mantra became: “Baby, don’t drill. Baby, don’t drill.”

But has demand for oil disappeared? Not even close.

Commodities, like the Avatar, tend to vanish when you need them most. Think back to the COVID-19 pandemic: oil prices went negative because nobody wanted it — until, inevitably, they did. Markets self-correct with brutal efficiency. First, no one wants oil when it's cheap and abundant; then no one wants to invest in drilling because prices are low; eventually, supply contracts, production falls, but demand remains... and suddenly, there’s not enough oil to go around.dah

The 1973 Arab Oil Embargo should have been burned into America's memory like a scar. Overnight, the so-called energy superpower was reduced to gas lines, rationing, and panic — all because foreign producers decided to turn off the taps. It was a brutal reminder: if you don’t control your own energy, you control nothing. Fast forward to today, and the lesson still holds. Without drilling, producing, and refining at home, America risks handing its fate to regimes that hate it. Trump’s Energy Dominance agenda wasn’t just economic policy — it was survival instinct. Energy security isn’t optional. It’s the shield that keeps America strong when the world decides to play dirty.

History doesn’t repeat itself, but it sure knows how to rhyme.

Trump’s Executive Order about the American Energy Dominance idea was simple but crucial: ensure America isn’t just energy independent, but energy strong.

It’s about drilling, refining, producing, and safeguarding domestic resources — not just for today, but for decades ahead. It’s an acknowledgment that while renewables are the future, hydrocarbons are still the backbone of the present. Ignoring that reality risks the kind of supply shock we’ve seen — and suffered — before.

Drill, baby, drill — before it’s too late.

Get To Know The Executive Orders

Trump’s approach to energy was anchored in the principle of “energy dominance.” This included deregulation, enhanced domestic production, and reduced reliance on foreign energy—all while deprioritizing environmental safeguards and subsidies for renewable energy. The three most consequential EOs under this doctrine include:

Now, let's take a look at the current industry landscape. We’ll deep dive first on Alaska, with an EO 1453 discussing specifically this region. Executive Order 1453, titled “Unleashing Alaska’s Extraordinary Resource Potential”, represents one of the boldest moves by the Trump administration to reshape U.S. domestic energy production. The EO directly targets Alaska’s vast untapped reserves, particularly in the Arctic National Wildlife Refuge (ANWR) and the National Petroleum Reserve – Alaska (NPR-A).

By removing previous regulatory barriers and accelerating permitting processes, EO 1453 reactivated exploration rights in areas that had been politically and environmentally contested for decades.

Why Alaska? And Why ANWR?

While Executive Order 1453 presents a compelling investment thesis centered around unlocking Alaska’s vast untapped energy reserves, particularly within the Arctic National Wildlife Refuge (ANWR), it is essential for investors to contextualize this opportunity through both a historical and ecological lens.

The ANWR, established in 1960 by President Dwight D. Eisenhower and expanded in 1980 by President Jimmy Carter, spans an immense 19.6 million acres of wilderness. Within this expanse lies the 1.5-million-acre coastal plain—also referred to as the “1002 Area”—a biologically rich zone that has, for decades, served as the heart of conservationist efforts. This region is ecologically significant not only for its biodiversity—hosting over 250 species including polar bears, caribou, wolverines, and migratory birds—but also for its role in sustaining the cultural heritage and food security of the Gwich’in people. Each year, the Porcupine Caribou Herd traverses nearly 1,400 miles to calve in this coastal plain, making its protection a matter of both ecological and indigenous importance.

Despite consistent bipartisan public support for the protection of the Arctic Refuge, the coastal plain was officially opened to oil and gas development through a provision embedded in the Tax Cuts and Jobs Act of December 2017. This legislative maneuver represented the first time in U.S. history that a national wildlife refuge was re-designated for extractive industrial use. It also marked the culmination of over 50 failed congressional attempts to authorize drilling in the region—each previously defeated due to environmental, cultural, and legal pushback.

EO 1453 builds directly on this legislative shift, accelerating the leasing and permitting process in ANWR as part of a broader agenda to elevate domestic energy production. However, this aggressive deregulatory stance directly contradicts the Arctic Refuge’s current Comprehensive Conservation Plan, which recommends wilderness protection for the coastal plain and received widespread public support. Moreover, the executive order’s energy-centric redefinition of the Refuge’s purpose runs counter to its founding values of ecological preservation and public trust.

For investors, the potential returns from newly accessible oil reserves are enticing. The ANWR alone is estimated to contain 10.4 billion barrels of oil, a volume that could substantially extend the United States’ domestic production horizon. Companies such as ConocoPhillips ($COP), ExxonMobil ($XOM), and Chevron ($CVX), all with historical operational footprints in Alaska, stand to gain significantly should full-scale development proceed.

The ANWR Potential

ANWR was specifically set aside by Congress and President Carter in 1980 for oil and natural development & not designated as wilderness. The are has an estimated reserves of 10,4 Billion barrels that could supply up to 1,45 million barrels oil per day at peak production

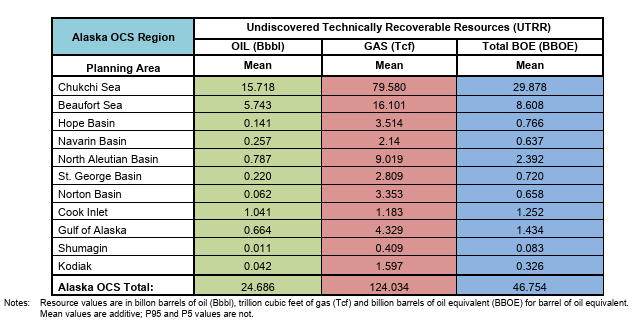

Based on the 2021 Assessment of Oil and Gas Resources by U.S. Department of the Interior Bureau of Ocean Energy Management Alaska Outer Continental Shelf Region, Alaska has an estimated Undiscovered Technically Recoverable Resources (UTRR) of 24,69 Bbbl of Oil Reserves and 124,03 Tcf of Gas Reserves

Further exploration could boost up the economy. From ANWR alone, ANWR’s resources could generate ~US$150-US$296 billion in Federal Revenue and create ~55K-130K of job openings.

So, Alaska clearly has a massive upside potential to be explored. But, everything comes at a cost. We identified few downside risks that may be impacted Trump plans and the interest over the region;

#1 LNG Exploration, is costly.

Converting natural gas into liquid requires significant capital expenditure, not only in production but also in delivery. This is because LNG requires gas tankers that can maintain LNG in fully pressurized/fully refrigerated or semi-pressurized/semi-refrigerated conditions.

The development of new LNG exploration facilities will take considerable time for permitting and construction. With new plan construction typically took 5 years to complete after a Final Investment Decision (FID).

#2 Potential Conflicts Awaits

Executive power only extends to areas owned by the federal government. Meanwhile, the majority of exploration takes place on private or state lands. Thus, there must be definite alignment among all stakeholders.

Political risk is high, ANWR could become a legal battleground with shifting party control. EO 1453 accelerates leasing, permitting, and exploration of ANWR’s coastal plain. However, this contradicts decades of conservation precedent and ignores millions of public comments supporting protection. Any lawsuit could delay the project timeline.

EO 1453 may offer massive upside in proven reserves and production capacity, but ANWR is not just another oil field—it is a symbolic flashpoint. Investors should treat ANWR exposure as high-reward, high-risk, and price in both upside from resource unlocks and potential downside from legal, ESG, and political resistance.

The Beginning of a New End, or The End of a New Beginning?

America still has a long way to go, but this marks a new beginning in its journey toward energy dominance. Once again, America is poised to reclaim its throne.

Beyond the potential developments in ANWR, another two key Executive Orders—EO 14156 and EO 14154—will be discussed in a forthcoming article. This is the rebirth story of American energy: a renewed era of exploration, production, transportation, and expanded storage capacity.