How Far Can The Bull Run?

A Data-Backed Outlook

After briefly dipping to $75,000 during the height of recent trade war tensions, Bitcoin has steadily climbed its way back up, mirroring the behavior of other risk assets. The market experienced a momentary sigh of relief following the announcement of a 90-day postponement in tariff escalations. This window of geopolitical calm has allowed Bitcoin to regain momentum. As of May 12, 2025, Bitcoin has successfully reclaimed the psychological $100,000 level, reigniting conversations about how far this bull market can go.

In this article, we’ll explore the key factors driving this rally, where we are in the current cycle, possible price targets based on historical cycles, and when this bull market might reach its blow-off top. Whether you’re a long-term holder or short-term trader, understanding these elements is very crucial to navigate what could be the final leg of Bitcoin’s current bullrun.

What’s Behind the Recent Price Relief?

Beyond the macro tailwinds from the temporary 90-day trade war postponement and descalation in the US-China trade war, one of the main drivers behind Bitcoin’s recovery is a clear surge in liquidity. As discussed in our previous article, “The Lifeblood of Markets: How Liquidity Shapes Bitcoin”, liquidity is the lifeblood of Bitcoin’s price action. In that article, we highlighted the potential for Bitcoin to rally by the end of April 2025, driven by an uptick in the M2 Money Supply.

This liquidity theme is further reinforced by the record-high levels of stablecoin liquidity observed at the end of April. As of April 30, 2025, total stablecoin market capitalization reached $220 billion. This increase was primarily fueled by expansions in the market cap of USDT (up $2.5 billion in a week) and USDC (up $1.2 billion), reflecting a significant influx of capital into the crypto space.

Looking at the longer-term trends, both USDT and USDC saw 30-day increases above respective moving averages—a signal that has consistently preceded rising Bitcoin prices in past cycles. USDT gained $5.3 billion and USDC $6.0 billion in the last month, both pushing above their 30-day trend lines. While USDT balances on exchanges remain 12% below their February peak ($38 billion vs $43 billion), USDC’s presence on exchanges has surged to $6.5 billion, marking its highest level since March 2023. This shift suggests not only greater available capital, but also a growing preference for USDC in a current trading environments.

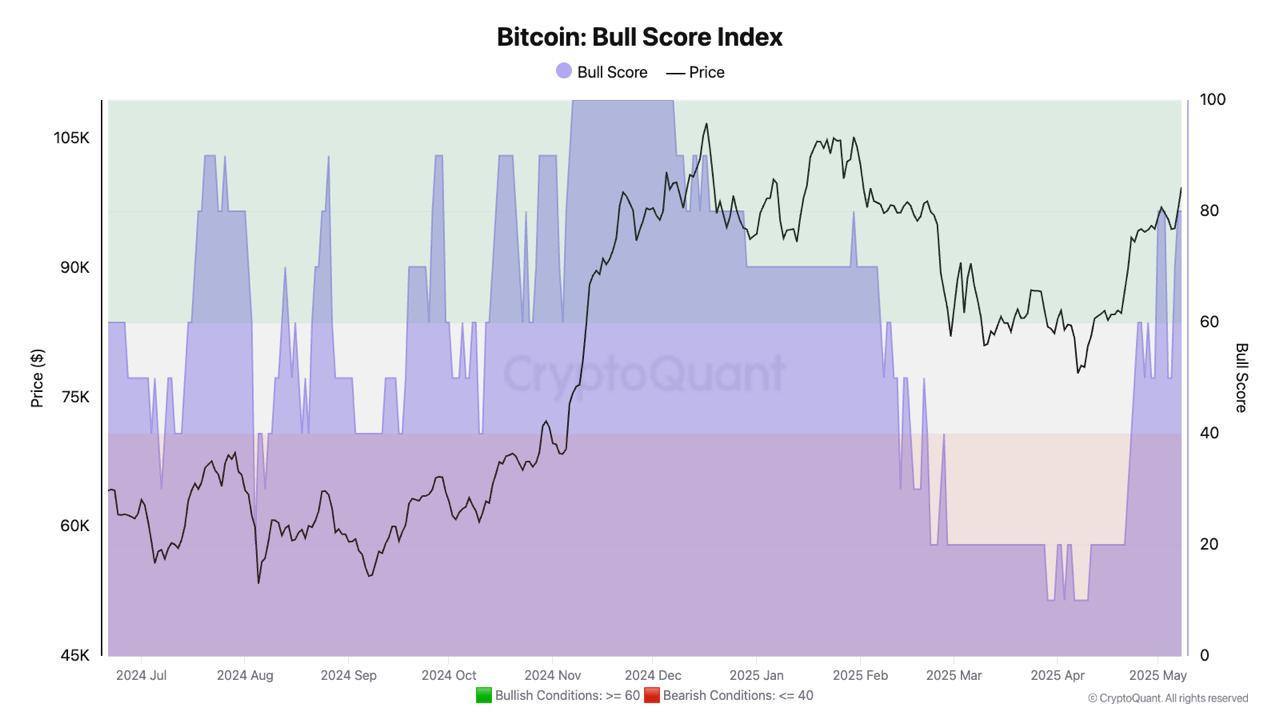

This wave of fresh capital has helped push the Bitcoin Bull Score Index—a composite indicator of market sentiment and liquidity—out of bearish territory. The index has climbed from a low of 20 to 50, now entering neutral ground. While it still falls short of the 60-point threshold typically associated with sustained bull runs, the shift reflects a meaningful improvement in underlying market conditions and growing investor confidence.

Where Are We in the Cycle?

To understand how much runway this bull market might still have, it’s very crucial to determine where we currently stand in the broader cycle. For that, we turn to a series of on-chain metrics that offer insight into holders profitability, investor behavior, and market valuation.

Holders Profitability : Are We in the Money?

One of the most insightful tools for identifying Bitcoin’s position in its market cycle is the Net Unrealized Profit/Loss (NUPL). It captures the aggregate unrealized profit or loss held by investors by comparing the market value (the current Bitcoin price times the number of coins in circulation) with the realized value (the price each coin last moved, summed and averaged across the network). By subtracting realized value from market value, we get unrealized profit/loss.

Following Bitcoin’s recent rally from $75,000 to above $100,000, NUPL has moved out of the optimism/hope zone and firmly into the belief/denial area. Historically, this suggests we are in the later part of the bull market. At this stage, most investors are in profit, and confidence is growing. But it’s also a phase where the market becomes more fragile, often just before a final price surge or a sharp reversal.

Investor Behavior : Who’s Buying the Rally?

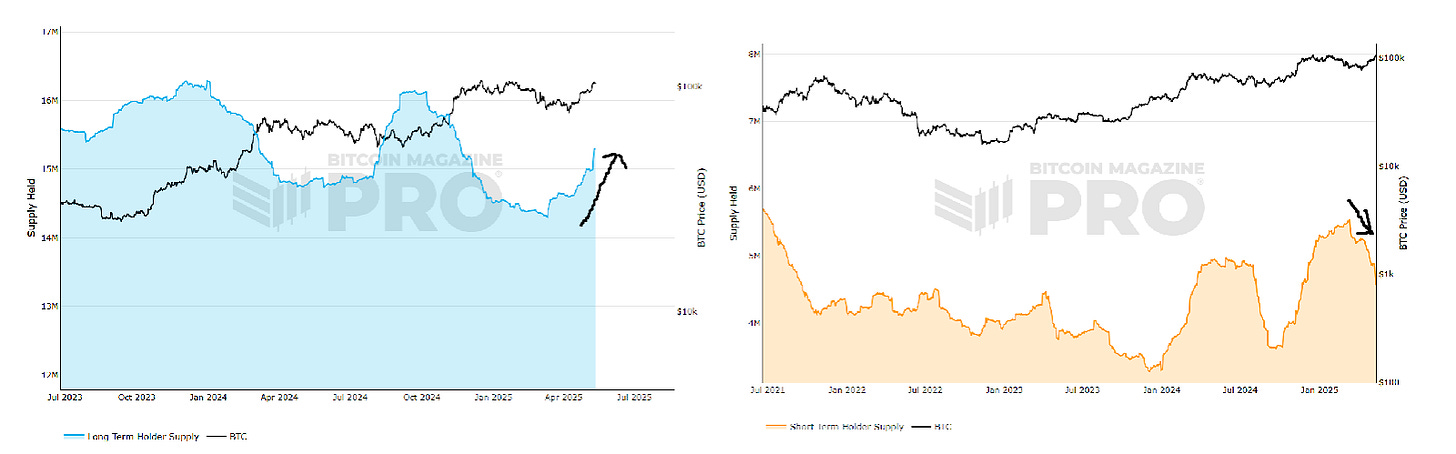

Understanding who is driving the current rally can tell us a lot about its strength and sustainability. To do this, we look at the behavior of two key groups: Long-Term Holders (LTHs) and Short-Term Holders (STHs).

The chart on the left shows the supply held by long-term holders—addresses that have held Bitcoin for more than 155 days. The chart on the right shows the supply held by short-term holders—those holding for less than 155 days. During the recent rally from $75,000 to above $100,000, it was long-term holders who added to their positions, while short-term holders actually reduced exposure. This suggests that conviction buyers—those with more patience and higher confidence—viewed the temporary drop to $75,000, triggered by tariff war fears, as a buy-the-dip opportunity. They likely believed the geopolitical tension wouldn’t last long and acted accordingly.

This behavior stands in contrast to the earlier move from $70,000 to $100,000, which occurred after Trump’s re-election announcement. In that case, short-term holders were the primary buyers, while long-term holders were distributing into the strength. Historically, when long-term holders are the ones accumulating, it’s considered a positive sign. It implies that the rally is being built on a stronger foundation of conviction rather than speculative hype—making any further upside more sustainable.

Market Valuation: Are We Overpaying?

To understand whether Bitcoin is currently overvalued or undervalued, one of the most reliable on-chain metrics is the MVRV ratio—short for Market Value to Realized Value. Market Value is the current price of Bitcoin multiplied by the total number of coins in circulation—essentially, Bitcoin’s market cap. Realized Value, on the other hand, represents the total value of all Bitcoins based on the price at which each coin was last moved on-chain. Rather than using the current price, it looks at the price each Bitcoin was last transacted. By summing these values and dividing by the number of coins in circulation, we get the network’s average cost basis—what investors actually paid for their Bitcoin. The MVRV ratio compares these two metrics. It shows how far the current market price has diverged from the average cost basis of holders. Historically, an MVRV above 3.7 has signaled market tops, while an MVRV below 1.0 has coincided with market bottoms.

As of now, the MVRV sits at 2.2. This means that, on average, the market is valuing Bitcoin at roughly 2 times what most holders paid for it. While this is not yet in the "overheated" zone, it clearly shows we are no longer in the undervalued part of the cycle. The risk-reward tradeoff has shifted: prices can still climb higher, but buyers are paying a noticeable premium.

How Much Higher Can We Go?

Predicting exact prices has never been our thing. However, by looking at historical price models, we can identify key levels that might act as possible targets or resistance. Not certainties, but navigational tools to help us understand the potential ceiling of this bull cycle. It’s important to note that these models shouldn’t be treated as absolute forecast. A blow-off top doesn’t have to occur at these levels. Rather, they help us map the landscape of possible outcomes based on previous market behavior. That said, these levels only come into play if Bitcoin is able to break and flip its all-time high of $109,026 into support. Without this confirmation, any projections further upward remain speculative.

One of the most useful models for visualizing potential price ceilings is the Golden Ratio Multiplier (GRM). GRM model uses the 350-day moving average of Bitcoin’s price as a baseline and multiplies it by key Fibonacci levels—0, 1, 1, 2, 3, 5, 8, 13, 21—as well as the Golden Ratio (1.6). Historically, these multipliers have acted as reliable signals for identifying local tops and cycle blow-off tops.

Looking at the chart, we can observe a clear diminishing return pattern. The first bull cycle topped at the 8x multiple, the second cycle peaked near the 5x line, and the third cycle hit the 3x line. This trend suggests that each new cycle sees less aggresive upside, potentially due to market maturity and increasing capital requirements for exponential gains.

If the diminishing return pattern continues, this cycle’s peak could land between the 2x and 1.6x multipliers, which corresponds to the following price targets:

Bull Case (2x line): $158,868.84

Base Case (1.6x line): $127,095.07

Worst Case: We’ve already seen the top at $109,026

These levels aren’t predictions, but if Bitcoin enters a true parabolic phase and flips the previous all-time high into support, they may become relevant targets to watch as the cycle matures.

When Might This Cycle Peak?

Predicting when a market cycle will top out is extremely difficult, like trying to peer into a crystal ball. However, while we can’t know the exact moment of the peak, we can turn to historical patterns to guide our expectations.

One such tool is the Halving Seasonality Index (HSI). This indicator leverages the cyclical behavior of Bitcoin following its halving events. Historically, except for the first halving cycle, Bitcoin has consistently formed its macro tops around 538 days after each halving. HSI is constructed by marking a window of 528 to 548 days post-halving, essentially a 20-day band centered around the 538-day average. This window has historically been a reliable period during which Bitcoin’s cycle top has emerged. Given the most recent halving occurred on April 20, 2024, this would place the potential top somewhere between mid-September to early October 2025—if history is any guide.

Final Thoughts: Navigate with Discipline, Not Emotion

While the current Bitcoin rally may still offer more room to run, it’s very important to acknowledge that we are no longer in the early, asymmetric phase of the cycle. Price have moved significantly, sentiment has improved, but this is not the time to chase, it’s time to act with discipline.

At this stage, a data-driven approach it’s essential. Instead of waiting a perfect price or a specific date to exit, consider trimming gradually. History has shown that attempting to sell precisely at the top is nearly impossible and often counterproductive, leading to poor psychological decisions. Avoid turning the market into a gambling table.

You can start building your exit framework using risk-adjusted metrics like the ones discussed in Time in the Market. This can help remove emotions from the equation and make your decision-making more systematic. Remember: it's not about selling everything at once, nor about holding forever. It’s about managing risk wisely—especially in a phase where the upside may still exist, but no longer looks asymmetrically in your favor.