Preface

There’s a saying that goes “Consistency is the name of the game”, this principle applies not just to sports, personal development, or business but also to investing. One of the most well-known ways to stay consistent in investing is through Dollar-Cost Averaging (DCA). However, many people overlook an essential factor: consistency alone is not enough. It’s just as crucial to choose the right asset when applying DCA. Investing regularly in asset with weak fundamentals or long-term decline won’t yield the results you expect. In this article, we’ll explore what DCA is, covering its concept, benefits, and how Bitcoin has performed using a DCA strategy. We’ll also explore dynamic DCA, an alternative to traditional DCA that adjusts investment amounts based on risk metrics in the context of Bitcoin.

What is DCA ?

Dollar-Cost Averaging (DCA) is an investment strategy where an investor regularly buys a fixed amount of an asset, regardless of its price fluctuations. Instead of investing a lump sum at once, an investor using DCA to spreads their purchases over time. This approach helps mitigate the risk of market volatility, as it ensures that investments are made at different price points, averaging out the cost over time.

For example, consider two investors who each have $8,000 to invest in an asset. The first investor opts for a lump sum strategy, purchasing all units at a price of $10 each in January. However, as the market fluctuates, the price rises to $14 in February before dumping to $7.5 in July, only to return to $10 in August. Despite these fluctuation, the lump sum investor’s average unit cost remains $10, and by the end of the period, their return is 0%.

Meanwhile, the second investor follows follows the DCA strategy, investing $1,000 every month instead. Since prices vary, this investor acquires more units when prices are low and fewer when prices are high. As a result, their average unit cost becomes $9.61, lower than the lump sum investor’s cost. By August, when the asset price is at $10, the DCA investor sees a positive return of 4.07%. Based on the illustration, we can conclude that the benefits of using the DCA strategy are as follows:

Reduces Timing Risk → Since investments are made at regular intervals, DCA advoids the challenge of trying to time the market perfectly.

Mitigates Volatility Impact → Buying at different price points reduces exposure to short-term market swings.

Encourages Discipline → DCA promotes a systematic, emotion-free approach to investing.

Accessible to All Investors → Instead of needing a large sum upfront, investors can start with smaller amounts.

How Bitcoin Performed Under DCA Strategy ?

When applying a Dollar-Cost Averaging strategy, choosing the right asset is very crucial. While consistency in investing is very important, consistently allocating capital into an asset with poor fundamentals or long-term underperformance can lead to disappointing results. Obviously, not all assets are ideal for a DCA strategy. A strong candidate for DCA should have:

Long-term upward trajectory → The asset should have a history of appreciating in value over extended periods.

Fundamental strength → It should be backed by strong utility, adoption, or economic value.

High volatility → While this may seem counterintuitive, volatility allows DCA to take advantage of price fluctuations, lowering the average cost over time.

One of the assets that fits these criteria well is bitcoin. To better understand bitcoin’s suitability for a DCA strategy, we will analyze how it has performed under different DCA approaches. Specifically, we will compare the effectiveness of daily, weekly, biweekly, and monthly strategis to determine which frequency yields the best results. To conduct this analysis, we will use historical data from the past four years to simulate how an investor deploying a total capital of $10,000 would have fared under each strategy.

Using historical price data from March 16, 2021, to March 16, 2025, we find that daily, weekly, bi-weekly, and monthly DCA strategies have yielded relatively similar returns (%) over the period. In contrast, a lump sum investment of $10,000 on March 16, 2021, at the Bitcoin price of that time, would have resulted in a return of only 41.9% based on Bitcoin’s price of $83,650.31 at the time of writing. This data proves that DCA is a more effective strategy compared to lump sum investing, as it helps mitigate market timing risk. Given that the returns among weekly, bi-weekly, and monthly DCA are relatively similar, a monthly DCA strategy is the most practical choice as it minimizes transaction fees associated with frequent purchases.

Dynamic DCA with Risk-Based Adjustments

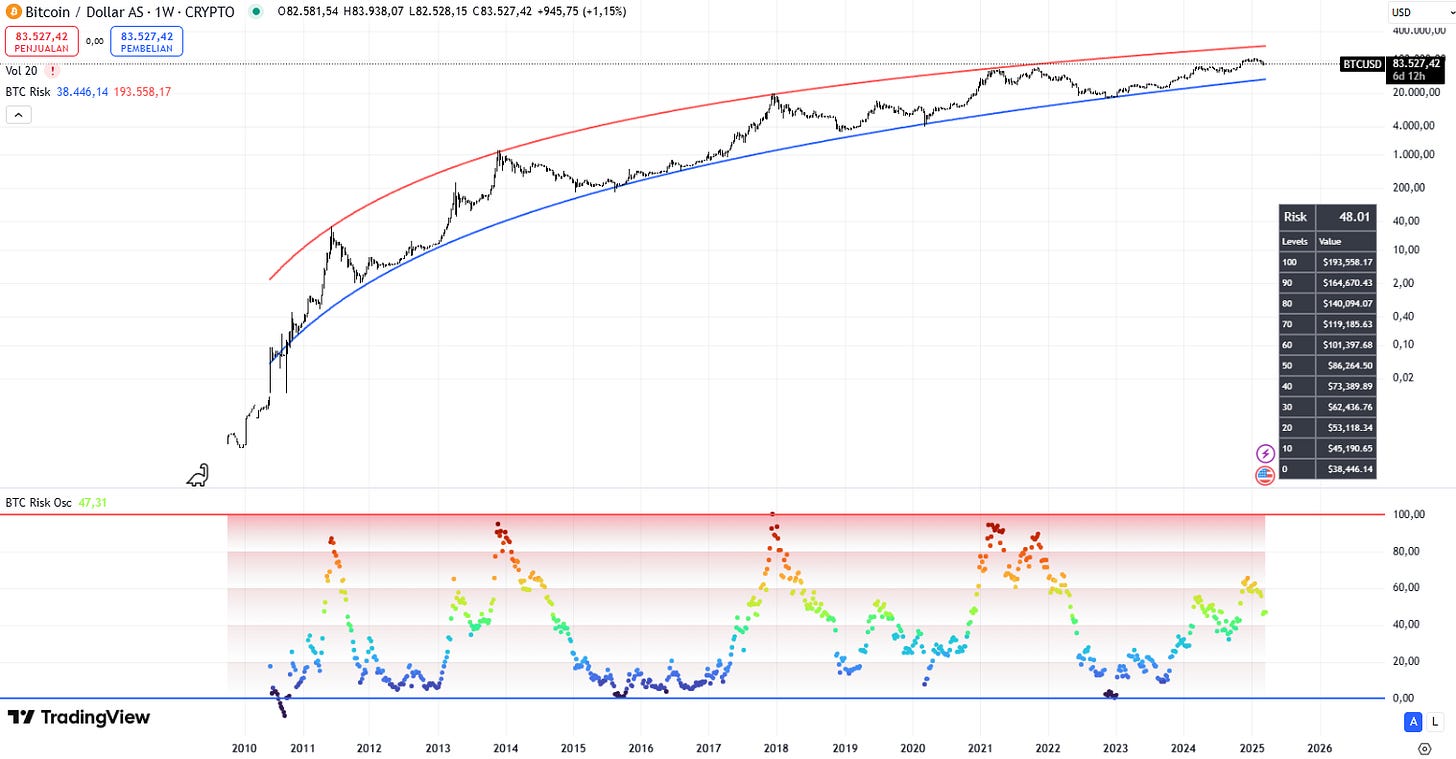

Dynamic DCA is an enhancement of the standard DCA that adjusts investment allocations depending on market conditions. Instead of blindly investing the same amount regardless of market valuation, dynamic DCA allocates more capital during undervalued periods and reduces investment size (or even sells) during overvalued periods. One effective way to implement this strategy is by using bitcoin risk metrics, a model that assigns a risk score to bitcoin’s price based on power law regression and historical valuation trends.

We believe that the bitcoin risk metric provides a valuable perspective on Bitcoin's relative valuation by analyzing the ratio between the 50-day and 350-day Simple Moving Averages (SMA). This ratio is then normalized to a scale of 0 to 100, making it easier to interpret. Lower values suggest that Bitcoin is in a low-risk accumulation phase, while higher values indicate increased market risk, often aligning with price peaks. By tracking this metric, investors can make more informed decisions about capital allocation and gradual profit-taking based on bitcoin’s historical price trends.

This risk scale, ranging from 0 to 100, allows investors to make data-driven decisions:

Low risk (0-30, blue) → bitcoin is historically undervalued, so we increase DCA contributions.

Medium risk (30-50, green/yellow) → bitcoin is fairly valued, so we maintain moderate DCA contributions (or just hold aka no trade zone).

High risk (50-100, orange/red) → bitcoin is historically overvalued, so we can sell gradually.

This dynamic DCA strategy offers several key advantages over traditional DCA. Here are some of the main benefits:

Improved Capital Effiency → Traditional DCA spreads capital evenly, even when an asset is overvalued. Dynamic DCA maximizes capital efficiency by allocating more during dips and cutting back during peaks.

Better Risk Management → Selling portions of the portfolio at high-risk levels help to lock in profits and reduce downside exposure during potential market crashes.

Higher Potential Returns → Historically, investor who allocate capital strategically based on valuation metrics achieve higher overall returns than those using fixed allocation methods.

Psychological Benefits → Investor often struggle with emotions when buying or selling. Dynamic DCA removes subjectivity by relying on a systematic, rule-based approach rather than gut feelings.

With the current market conditions, the risk level stands at 47.62 (price around $83,000), with the following detailed breakdown:

After knowing current risk levels, bitcoin risk metrics can be effectively used to implement a dynamic DCA strategy, allowing investors to optimize both accumulation (DCA-In) and profit-taking (DCA-Out).

DCA-In

When bitcoin is undervalued, a larger portion of the capital is allocated to maximize accumulation. For example, if an investor has $500 per month to invest, the allocation is adjusted as follows:

Risk 0-10 → Invest $500

Risk 11-20 → Invest $400

Risk 21-30 → Invest $300

Risk 31-40 → Invest $200

Risk 41-50 → Invest $100

This tiered approach ensures that investors deploy more capital when bitcoin is cheap and gradually reduce purchases as valuation increases.

DCA-Out

Once bitcoin reaches higher risk levels, investors should begin gradually reducing their holdings to lock in profits and manage risk. The equation governing this strategy is:

y + 2y + 3y + 4y + 5y = Total BTCwhere y represents the base unit of bitcoin holdings to be sold at lower risk levels. For example, an investor holding 10 BTC, we solve for y:

y + 2y + 3y + 4y + 5y = 1015y = 10y = 10/15 = 0.67 BTCUsing this value, the DCA-Out allocations are as follows:

Risk 51-60 → Sell y = 0.67 BTC

Risk 61-70 → Sell 2y = 1.34 BTC

Risk 71-80 → Sell 3y = 2.01 BTC

Risk 81-90 → Sell 4y = 2.68 BTC

Risk 91-100 → Sell 5y = 3.35 BTC

This method ensures that as Bitcoin becomes more overvalued, a greater proportion of holdings is sold, securing profits while still allowing for potential upside in lower-risk phases.

Dynamic DCA framework is fully customizable based on individual risk tolerance and market outlook. One possible variation is Exponential Scaling, where instead of using linear multiples (1,2,3,...), investors allocate/sell capital exponentially (1,2,4,8,16,...), allowing them to inload/offload much larger portion at extreme price levels. Alternatively, some investors may opt for Threshold-Based Adjustments. For example, sales only begin once Bitcoin surpasses a specific risk threshold, such as 60, ensuring they remain invested during moderate risk periods while still securing profits at higher levels.

Closure

Bitcoin has proven to be a suitable asset for the Dollar-Cost Averaging (DCA) strategy, given its high volatility and long-term growth trend. Historical data and studies indicate that DCA is a more optimal approach compared to lump-sum investing, reinforcing the principle that time in the market beats timing the market. For investors looking to allocate capital or take profits gradually, utilizing the BTC Risk Metric can provide a more structured and effective strategy. This approach allows for better asset accumulation and risk management in alignment with market conditions. In the next article, we will explore an alternative approach, timing the cycle bottom using on-chain indicators to optimize Bitcoin accumulation.