Bitcoin 101: Part II

Bitcoin Under The Hood : The Tech Behind Bitcoin

Cryptographic, mining, and Proof-of-Work

Like other technologies created during times of crisis, Bitcoin emerged as a new hope following the global crisis in 2008. To provide a brief overview before we discuss it in more detail, Bitcoin is a decentralized digital currency and a peer-to-peer network that enables secure, borderless, and trustless transactions without reliance on a central authority such as a bank or government. It operates on a public ledger known as the blockchain, where all transactions are recorded transparently and immutably. Unlike traditional currencies, Bitcoin has no physical form. Instead, it exists as a record of transactions that transfer ownership between users. Transactions are secured through cryptographic keys, allowing users to control and spend their Bitcoin by signing transactions digitally.

New Bitcoin are created through a process called mining, where networks participants, known as miners, compete to solve complex mathematical problems that validate and record transactions. Every 10 minutes, on average, a miner successfully verifies transactions and is rewarded with newly issued Bitcoin. This process decentralizes currency issuance and transaction validation, eliminating the need for a central bank. The mining process is regulated by built-in algorithms that adjust the difficulty adjustment, ensuring that blocks are mined approximately every 10 minutes, regardless of the total computational power in the network. Additionally, Bitcoin follows a predetermined issuance schedule, where the number of new Bitcoin created is halved approximately every four years. The total supply is capped at just 21 million coins, and due to this halving mechanism, the fully supply is expected to be in circulation by the year 2140. This predictable issuance model makes Bitcoin a deflationary asset, resistant to inflation and arbitrary monetary expansion.

Bitcoin decentralized nature is maintained through a consensus mechanism known as Proof-of-Work (PoW), which ensures network security and prevent fraud, such as double-spending. By combining these technologies, Bitcoin represents a revolutionary advancement in digital finance. Often referred to as the “internet of money”, it provides an open, permissionless financial system that enables individuals worldwide to transfer and store value efficiently, securely, and independently. In the next sub-section, we will discuss in more detail some of the technologies in Bitcoin.

Blockchain

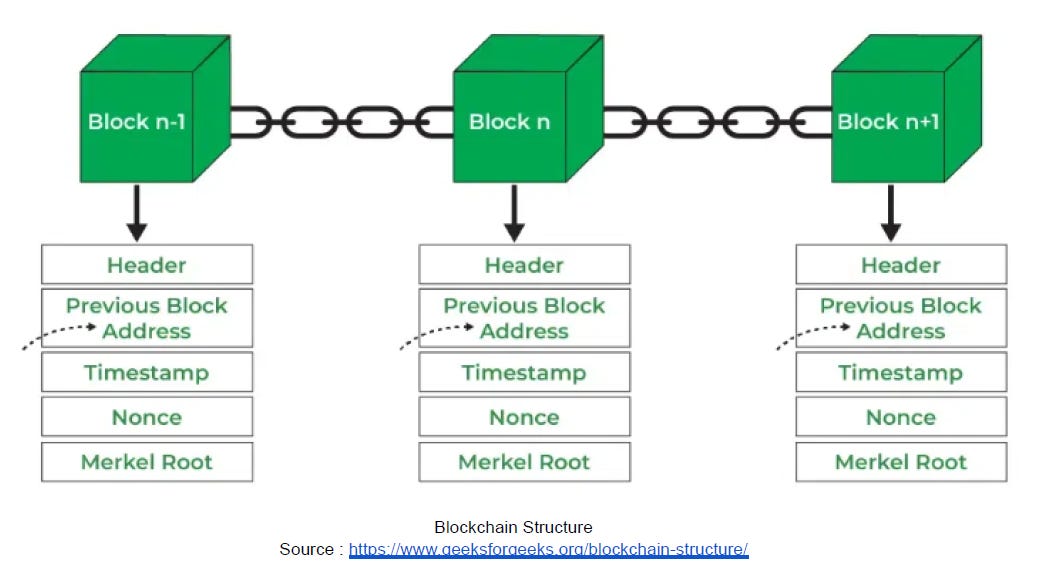

Blockchain is a decentralized public ledger that records all Bitcoin transactions permanently and transparently. It consists of a sequence of blocks, each containing a list of verified transactions. Each block references the previous one through a cryptographic hash, forming an immutable chain that extends back to the Genesis Block, the first block created in Bitcoin network.

Each block in the blockchain consists of two main components: block header and the transaction list.

Block header is a compact yet essential component of a Bitcoin block, measuring only 80 bytes in size. In contrast, an average Bitcoin transaction is at least 250 bytes, and a single block typically contains more than 500 transactions, making a full block approximately 1,000 times larger than its header. Despite its small size, block header plays a crucial role in linking blocks together. Structurally, the block header consists of these metadata:

1. Previous Block Hash

The previous block hash is a cryptographic hash of the header of the preceding block. This field ensures that each block is linked to the previous one, forming a continuous, tamper-resistant chain. If any block in the chain is modified, its hash will change, breaking the connection with the next block and invalidating the entire chain. This feature enforces immutability in the blockchain, making it resistant to tampering and fraud.

2. Timestamp

Timestamp representing the approximate time when the block was created, measured in Unix time (seconds since January 1, 1970, UTC). The timestamp helps nodes synchronize the blockchain and is also used in adjusting the mining difficulty.

3. Nonce

Nonce is a 32-bit integer that miners continuously adjust during the mining process to find a valid block hash. Since Bitcoin uses the Proof-of-Work (PoW) mechanism, miners must find a hash of the block header that is below a certain target value. They do this by incrementing the nonce and rehashing the block header until they find a valid hash.

4. Merkle Root

Merkle Root is another hash that represents all transactions included in the block. It is derived using a Merkle Tree, a cryptographic structure where transactions are hashed and combined in pairs repeatedly until a single hash (Merkle Root) is produced. Merkle Root ensures transaction integrity because any modification to a transaction will alter the Merkle Root, causing the block header hash to change as well.

Mining and Consensus

Mining is often misunderstood as merely a way to generate new Bitcoin, but its primary function is to validate and record transactions on the blockchain in a decentralized manner. Unlike traditional financial systems that rely on central authorities for transaction verification, Bitcoin mining ensures security and consensus across the network through cryptographic mechanisms. This process is carried out by entities known as miners. Miners works by gathering unconfirmed transactions and assembling them into a block. To add this block to the blockchain, miners must solve a complex mathematical problem known as the network consensus “Proof-of-Work”. This process involves searching for a hash value that meets the network’s difficulty target, which can only be achieved through trial and error using substanstial computational power. The difficulty adjustment mechanism recalibrates approximately every 2016 blocks (about two weeks) to maintain a steady block production of roughly 10 minutes, regardless of fluctuations in mining power. Once a miner finds a valid solution, they broadcast the block to the entire network, where other nodes verify its validity before adding it to the blockchain.

As a reward for their efforts, miners receive two types of compensation: block rewards and transaction fees. The block reward consists of newly created Bitcoin that are issued every time a block is successfully mined. Initially, this reward was set at 50 BTC per block in 2009 but undergoes a halving every 210,000 blocks, or approximately every four years. The reward was reduced to 25 BTC in 2012, then to 12.5 BTC in 2016, and further halved to 6.25 BTC in 2020. In April 2024, the block reward halved again to 3.125 BTC, continuing the programmed reduction in new Bitcoin issuance. This cycle will persist until around the year 2140, where all 21 million Bitcoin will have been mined. If we look closely, it can be formed as this mathematical equation.

In addition to block rewards, miners earn transaction fees, which are fees paid by Bitcoin users to have their transactions included in a block. The size of the transaction fee varies depending on network congestion and transaction priority. Currently, most mining revenue still from block rewards, but as new Bitcoin issuance declines, transaction fees will gradually become the primary source of income for miners.

Over time, Bitcoin mining has undergone significant technological evolution. Early miners used CPUs, but as competition increased, they transitioned to more efficient GPU,FPGA (Field-Programmable Gate Array), and eventually specialized ASIC (Application-Spesific Integrated Circuit) miners designed exclusively for hashing. This increase in mining difficulty has also led to the rise of mining pools, where multiple miners contribute computational power and share rewards based on their contribution.

Mining a single Bitcoin requires a significant amount of electricity. After the 2024 halving, the estimated energy consumption to mine 1 BTC is approximately 6,400,000 kilowatt-hours (kWh). If attempted by a solo miner, it could take around 12 years, consuming nearly 44,444 kWh per month. To put this into perspective, the energy needed to mine 1 BTC could power 61 US homes for an entire year, this amount of energy could allow a Tesla Model 3 to circle the Earth more than 86 times.

The cost of mining 1 BTC varies significantly depending on electricity prices in different countries. Countries with lower electricity costs make mining more profitable, whereas regions with high energy prices can make mining unviable. Most profitable country is Iran, where mining 1 BTC costs just $1,324, and the least profitable country is Ireland, where the costs exceeds $321,112 per BTC. In terms of regional trends, Asia continues to dominate mining profitability, with over 20 countries offering favorable conditions after the 2024 halving. On the other hand, Europe faces significantly higher costs. In countries like Germany and UK, mining costs can be up to five times higher than Bitcoin’s market price, making it an unprofitable endeavor.

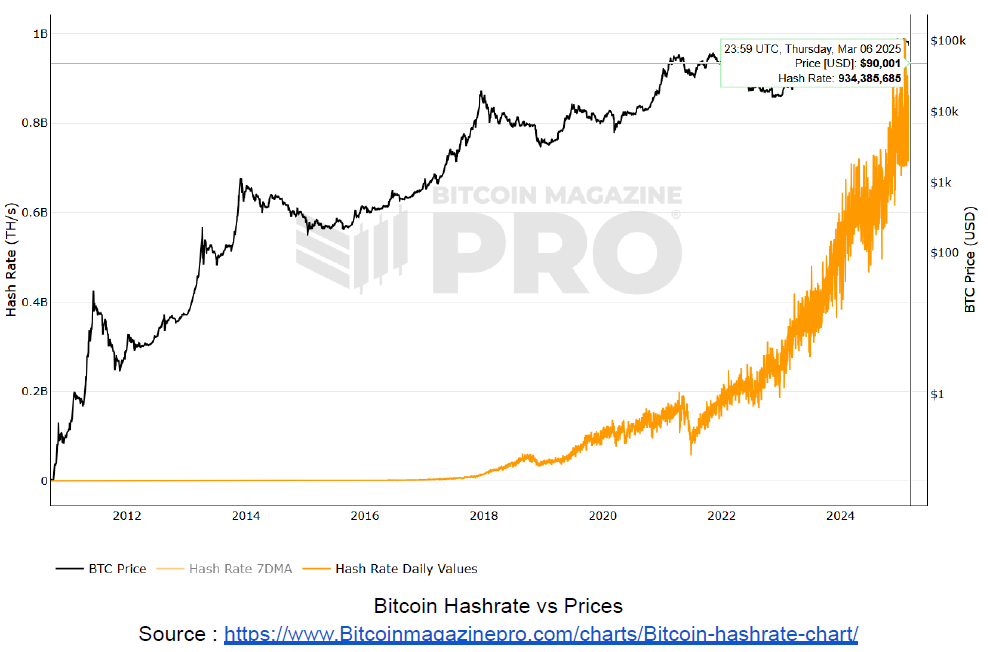

The graph above illustrates Bitcoin’s price and hash rate. Hash rate refers to the computational power used by miners to process transactions and secure the Bitcoin network. It is measured in TH/s (tera hashes per second) → 1 trillion hashes per second and represents how many cryptographic calculations (hashes) miners perform each second to find a valid block in the Proof-of-Work (PoW) system. As of March 6, 2025, the total hash rate of the Bitcoin network is 934,385,685 TH/s. Eventhough Bitcoin prices fluctuate, the network’s hashrate has been steadily increasing, making Bitcoin more secure over time.

Cryptography

You may have heard that Bitcoin is a cryptocurrency. It’s because Bitcoin built on cryptography, a branch of mathematics applied in securing digital systems. While the term originally translates to “secret writing” from Greek, cryptography today encompasses more than just encryption. It enables mechanisms like digital signatures, which allow users to prove ownership without exposing their private information, and digital fingerprints which verify data integrity. These cryptographic methods are fundamental to Bitcoin, ensuring security and trust without relying on a central authority.

In Bitcoin, ownership is determined by digital keys, addresses, and cryptographic signatures. These keys are stored on a central database but are generated and managed within a wallet, a software application that holds private keys. Bitcoin’s cryptographic system operates through public-private key pairs. The private key functions like a digital password that grants control over funds, while the public key acts as an identifier, similar to a bank account number, allowing others to send Bitcoin to the owner. Despite their importance, users rarely interact with these keys directly, as wallet software manages them automatically. Instead, transactions typically use Bitcoin addresses, which are shortened representations of public keys that serve as the recipient’s payment destination. We will break it down into pieces to make it easier for you to understand.

Public Key Cryptography

Bitcoin uses public key cryptography. Developed in the 1970s, it relies on mathematical functions such as prime number exponentiation and elliptic curve multiplication, which are straightforward to compute in one direction but nearly impossible to reverse. This property makes them ideal for creating digital signatures, allowing users to verify information without exposing private data. Bitcoin employs elliptic curve cryptography (ECC) to generate two linked keys: private key & public key.

Private and Public Keys

A Bitcoin wallet contains multiple key pairs, with each pair consisting of a private key and a public key.

The private key (k) is a randomly selected number that serves as the foundation of Bitcoin ownership. Using elliptic curve multiplication, a one-way cryptographic process, the private key is transformed into a public key (K). To further enhance security and create a shareable identifier, the public key undergoes a one way cryptographic hash function, resulting in a Bitcoin address (A). Bitcoin uses this type of cryptography not to hide or encrypt transactions. Instead, it is used to create digital signatures, which prove that a transaction is valid. Here’s how it works:

● Every Bitcoin owner has a private key, which is like a secret password.

● When they want to send Bitcoin, their private key is used to create a digital signature for the transaction. This signature is unique and cannot be faked.

● Other people in the Bitcoin network can check this signature using the sender’s public key, which is like an open ID that anyone can see.

● If the signature is valid, it proves that the transaction was authorized by the owner of the private key, without actually revealing the private key itself.

This system ensures that only the real owner of the Bitcoin can send it, while everyone else can verify that the transaction is legitimate. In the following discussion, we will explore the process of generating a private key, the mathematical principles behind converting it into a public key, and the final step of deriving a Bitcoin address from the public key.

● Generating Private Key

A private key plays a crucial role in Bitcoin ownership. Whoever holds the private key has full control over the Bitcoin linked to it. Because the private key is the only way to access Bitcoin

funds, it must always be kept secret. If someone else gets access to your private key, they can spend your Bitcoin. Similarly, if you lose your private key, you will permanently lose access to your Bitcoin, as there is no way to recover it.

Private key is a very large random number. In fact, you could even generate one manually by flipping a coin 256 times and writing down the result in binary (0s and 1s). However, Bitcoin software uses a random number generator from operating system to produce a 256-bit private key. A 256-bit number is simply a very large number that is 256 digits long in binary (0s and 1s). Since each bit can be either 0 or 1, a 256-bit number has possible 2256 values, which is an extremely large range. Bitcoin uses 256-bit private keys to ensure security. Since the number of possible private keys is astronomically large, it is practically impossible for someone to guess or brute-force a private key. For example, the number of possible Bitcoin private keys is far greater than the number of atoms in the observable universe, making it infeasible for an attacker to randomly find someone else's private key.

Mathematically, a private key must be a number between 1 and (n-1), where n is a very large number related to Bitcoin’s elliptic curve. To generate a valid private key:

1. Picks a random 256-bit number.

2. Checks if it is less than n-1.

3. If valid, the number becomes the private key. If not, the software picks another random number and tries again.

A private key in Bitcoin usually written in hexadecimal (base 16), which uses 16 characters: 0-9 and A-F for easier readability.

● Generating Public Key

A public key is generated from a private key using a mathematical operation called elliptic curve multiplication. This process is one-way, meaning that once a public key is created, it is impossible to reverse the process and find the private key. Mathematically, this written as:

𝐾 = 𝑘 𝑥 𝐺*) Formula above is not regular multiplication. It is elliptic curve point multiplication.

where is the the public key, is the private key, and is the generator point (a fixed point 𝐾𝑘𝐺on the elliptic curve). Since this calculation is based on elliptic curve, reversing it or meaning to find if you only know is nearly impossible. This is because it would require testing 𝑘𝐾every possible private key in what is called a brute-force attack.

Elliptic Curve Cryptography (ECC) Explained

Elliptic Curve Cryptography is a very complex mathematical concept, making it challenging to explain in simple terms. However, let’s use an analogy to make it more intuitive.

Imagine a special pool table where balls bounce off the walls following precise mathematical rules, similar to how points behave on elliptic curve. When two balls collide, their interaction

determines the position of a third ball, just like how ECC defines point addition. Now, if you strike a ball a certain number of times in a specific way, it will land in a particular position. The number of times you hit the ball represents the private key, while the final position of the ball is the public key. The security of ECC lies in the difficulty of working backward. While it’s easy to track where ball goes (from private key to public key), it’s nearly impossible to determine how many times it was hit just by looking at its final position.

● Generating Bitcoin Address

A Bitcoin address is a unique string of letters and numbers used to recieve Bitcoin, similar to a bank account number but generated from a public key.

To create a Bitcoin address, public key undergoes a one-way cryptographic hashing process. First, it is processed using the SHA256 hash function, which scrambles data securely. Then, it goes through another function called RIPEMD160, which shortens it to 160 bits. This final hashed version becomes the Bitcoin address, making it impossible to reverse-engineer back to the public key or private key. To improve readability and prevent errors, Bitcoin addresses are encoded using Base58Check, a format that removes similar-looking characters and includes a built-in error detection system. In simple terms, a Bitcoin address acts like a nickname for a long and complex public key, making it easier to share while maintaining security. Bitcoin has three main types of addresses:

● Legacy Addresses (P2PKH - Pay-to-PubKey Hash) = It is the oldest type of Bitcoin address, starts with “1” (e.g., 1J7mdg5rbQyUHENYdx39WVWK7fsLpEoXZy)

● Native SegWit Addresses = Starts with “bc1q” (e.g., bc1qw508d6qejxtdg4y5r3zarvary0c5xw7k4x6q2).

● Taproot Addresses (Bech32m) = Introduced in 2021 with the Taproot Upgrade, starts with “bc1p”.

Connecting The Dots : Explaining Bitcoin Transactions

In the previous section, we discussed some of the technologies used in the Bitcoin network. Now, let's piece everything together to illustrate how transactions work in the Bitcoin

network. Before that, we must understand about UTXO. UTXO stands for Unspent Transaction Output. In Bitcoin, transactions do not work like traditional bank accounts where balances by simply adding or subtracting amounts. Instead, Bitcoin transactions use an input-output system, where each transaction consumes previously received Bitcoin (inputs) and creates new Bitcoin outputs.

Each Bitcoin transaction produces one or more outputs, and any output that has not yet been spent is called UTXO. These UTXOs represent the Bitcoin that belongs to a user and can be used as inputs for future transactions. To make it easier to understand, let’s create a story illustration. For example, Alice and Bob are two friends who want to use Bitcoin to make a transaction. Alice owes Bob 0.05 BTC and decides to send it to him using her Bitcoin wallet. Let’s walk through the process step by step:

1. Alice Creates the Transaction

Alice opens her Bitcoin wallet, currently she has 0.1 BTC in her wallet, Alice enters Bob’s Bitcoin address. Since she has 0.1 BTC as a single UTXO, her wallet must spend the full amount and create new outputs. Her wallet constructs the transaction with:

● Input : 0.1 BTC (UTXO from a previous transaction).

● Outputs : 0.05 BTC sent to Bob, 0.049 BTC sent back to Alice as “change”, 0.001 BTC as a miner fee.

Alice signs the transaction with her private key, proving she owns the Bitcoin. By consuming the entire UTXO, Bitcoin ensures that the same UTXO cannot be used in two different transactions. If partial spending were allowed, an attacker could attempt to spend the same UTXO twice before the network confirms the transaction.

2. Broadcasting the Transaction to Nodes

Once signed, Alice’s wallet broadcast the transaction to the Bitcoin network, where it is received by multiple nodes. A node is a computer running Bitcoin software that helps maintain the network by verifying transactions and blocks. Each node checks Alice’s transaction, ensuring that:

● The UTXO she is spending exists and is unspent.

● The digital signature is valid, proving Alice is the rightful owner.

● The transaction follow Bitcoin rules (e.g, inputs outputs). ≥

Once verified, the nodes propagate the transaction to the rest of the network, including miners.

3. Miners Pick Up The Transaction

Bitcoin miners are special nodes that collect transactions and include them in new blocks. A miner picks up Alice’s transaction and groups it with others into a candidate block. To add the block to the blockchain, the miner must solve a complex mathematical puzzle (Proof-of-Work). This process is called mining and requires powerful computers. After several attempts, a miner successfully finds the correct solution and broadcasts the new

block to the network. Other nodes verify the block, and once it is confirmed, it is permanently added to the Bitcoin blockchain.

4. Bob Receives the Bitcoin

After Alice’s transaction is included in the blockchain, Bob’s wallet detects the new 0.05 BTC UTXO assigned to his Bitcoin address. This means he has officially received the payment, and Alice can no longer reverse the transaction. Bob can now use his 0.05 BTC UTXO as an input in a future transaction, just like Alice did. Bob can now use his 0.05 BTC UTXO as an input in a future transaction, just like Alice did. The cycle continues, with each transaction creating new UTXOs that can be spent later.

This is the second part of our Bitcoin 101 publication. On the third part, we are going to analyze Bitcoin’s impact on the monetary side, and how to custody your Bitcoin. Find the third part below: