Energy Unleashing, But Is It Really Profitable?

Recalling The Previous Articles

In the previous articles, we examined Trump’s energy-focused Executive Orders and explored why the United States must secure its energy future amid rising geopolitical and supply chain risks. Now, it’s time to ask the next question: who actually benefits?

Pause here a bit. If you’re wondering what we're talking about, spend 10-15 minutes reading Game Plan I and Game Plan II

These policies may not single out specific companies, but they clearly shift momentum across key sectors, from upstream drilling to LNG exports and offshore infrastructure. To bring this to life, we spotlight five companies that embody the opportunity. Think of them not just as tickers, but as lenses into what business models stand to be injected with steroids under a revived fossil fuel policy regime.

After two decades of climate-first narratives, America’s energy conservation is shifting back toward fossil-fueled realism. Thanks to a trio of executive orders, EO 1453 (Alaska & Arctic), EO 14154 (offshore drilling), and EO 14156 (LNG exports), the policy winds are blowing in favor of traditional oil, gas, and offshore exploration.

These aren’t just minor regulatory tweaks. They reshape investment potential across the entire energy value chain, from untapped Alaskan reserves to high-spec offshore rigs and the ships that serve them.

If It Was Too Good To Be True, Then It Is

If you’re currently thinking “I'm gonna go full leverage on oil”, please don’t! As good as it might be, as huge the potential it was, everything comes with a cost. Adam Smith in the 1700s argued how prices will be directly affected by supply and demand, with Alfred Marshall later coming up with the supply and demand curves. But as complicated as it goes, the bottom line is simple: when supply rises above demand, then prices will start to fall. This scenario most likely to come up in one of the 1,000 futures that Dr.Strange sees. There’s a huge probability, that this will happen eventually, here’s why:

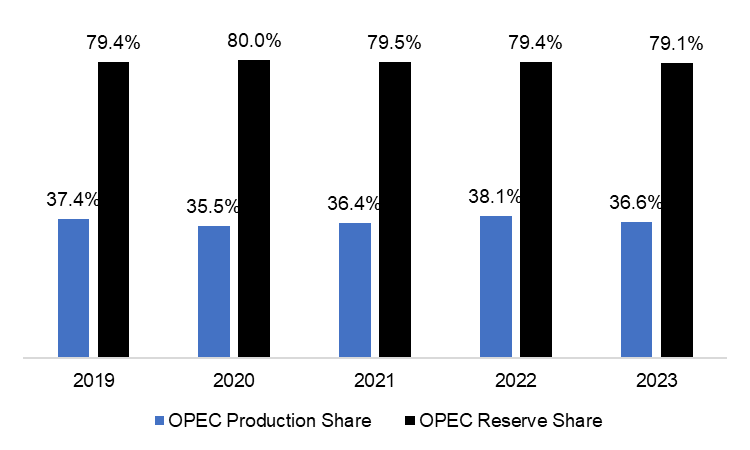

The only reason Trump wanted to unleash the US energy reserves potential was to stabilize the prices itself. Current oil prices are highly influenced by OPEC decisions on oil drilling. It was because they had ~30% of worldwide oil production with the largest reserve on earth. And the ability to increase and decrease billion barrels of oil to bring prices to benefit their cause.

By unleashing the US reserve potential, Trump will challenge the throne, the OPEC supremacy. He needs to make it happen to lower the oil prices, that will lead to lower inflation, and eventually cheaper cost of business. It may sound good for the whole ecosystem and Federal Government, but not as good as the producers.

Try to navigate this environment with a keen eye.

Energy Is Broad, Pick Your Cards Wisely

Potential lower price means not-so-good earnings. Lower oil prices will lead to lower revenue, and for some companies might also affect their bottom-line. With that in mind, investors should seek for companies that are not too sensitive to the oil price itself: companies that can benefit from sales volume or Capex for exploration. Let’s take a look at some of these companies.

There are three main value chains over the O&G sector; Upstream, Midstream, and Downstream. We summarized it here for you

Furthermore, OSV & Offshore Vessel, Oilfield Services, and Offshore Drilling rise as the Top 3 sectors which are less sensitive to oil price volatility.

The least sensitive segments to oil prices might just be the most profitable bets. Our regression analysis shows that Offshore Drilling, Oilfield Services, and Offshore Support Vessels (OSV) stand out as the most stable parts of the energy value chain. Their revenue performance shows low correlation to Brent crude prices, with R² values of just 0.37, 0.35, and 0.22 respectively. However, this regression analysis just simplifies the theoretical correlation which in reality the accuracy subject to each company’s sales contract terms and policy (which we have limited information on this). This indicates that their business fundamentals are shaped more by long-term capital expenditure cycles than by day-to-day market moves, making them attractive picks for investors seeking exposure to energy without overcommitting to oil price volatility.

These companies earn from consistent operations, not short-term price momentum. With earnings backed by long-term contracts and multi-year deployment schedules, these segments benefit from steadier cash flow and greater visibility. Offshore players rely on rig utilization, day rates, and vessel demand — not speculative commodity cycles. Oilfield service providers like Schlumberger also operate under project-based revenue models that span from drilling to subsea infrastructure. As offshore exploration gains policy support, these businesses are among the first to capture the momentum, often locking in contracts before the rigs even move.

The sector has been found, now it’s time to deep diver on the players

OSV & Offshore Vessel

Tidewater Inc (NYSE:TDW)

Tidewater is the undisputed leader in offshore support vessels (OSVs), critical assets for transporting personnel, equipment, and supplies to offshore rigs. As offshore drilling activity rebounds under EO 14154, Tidewater is strategically positioned to benefit from a surge in marine logistics demand, particularly in deepwater and harsh-environment fields.

Total Vessels by Category

16k BHP: 11 vessels

8–16k BHP: 21 vessels

4–8k BHP: 20 vessels

900 m²: 69 vessels

700–900 m²: 48 vessels

<700 m²: 21 vessels

TDW Fleet is dominated by PSV’s which have higher Daily Charter Rates compared to AHTS. Averages age at 12 years old. Definitely a young, massive, and productive fleet composition.

With over 180 vessels, Tidewater operates the largest high-specification OSV fleet globally, far ahead of competitors like Chouest, COSL, and Bourbon. The company also boasts one of the youngest average fleet ages among major players, giving it a performance, efficiency, and reliability edge in tight offshore markets.

Tidewater’s Fleet capable of:

Offshore exploration and production support

Wind farm construction and subsea services

Anchor handling, towing, and seismic operations

Transport for drilling rigs and subsea installations

TDW’s day rates have continued to rise, improving gross margins. The trend began in 2021 and has persisted to the present, with day rates increasing from approximately $10,000 to $20,000, while gross margins soared from ~25% to ~50%, generating stronger cash margins. TDW has sold older OSVs to acquire younger vessels in order to improve day rates. As demand for OSVs increases, operators with a younger fleet are positioned to be more productive and achieve better margins.

Source: Morningstar, latest earnings

Daily Charter Rate of OSVs keep rising since pandemic, boosting TDW’s Revenue, EBITDA, and EBITDA Margin on upward trend.

Oilfield Services

Schlumberger NV (NYSE:SLB)

Schlumberger is the world’s largest oilfield services company, operating in over 120 countries and delivering critical technologies for drilling, reservoir evaluation, well construction, and production optimization. It stands out as a top beneficiary of EO 14154, which reopens U.S. offshore acreage, an area where SLB excels, especially through its OneSubsea joint venture, a leader in deepwater engineering.

Source: Morningstar, latest earnings

The company operates through four key divisions:

Digital & Integration (11.8% of Revenue): Subsurface data, simulation, and AI integration

Reservoir Performance (20% of Revenue): Well evaluation and stimulation (e.g. hydraulic fracturing)

Well Construction (35.1% of Revenue): Drilling tools, fluids, bits, rig services

Production Systems (34.6% of Revenue): Artificial lift, completion equipment, subsea systems

SLB offers end-to-end offshore and onshore services, including directional drilling, formation evaluation, completions, and advanced subsea technologies like subsea trees, manifolds, and control systems. It also plays a growing role in carbon management and adjacent energy systems.

As offshore drilling rebounds under a pro-oil policy regime, SLB is well-positioned as the technology backbone of the next deepwater cycle.

SLB’s Revenue does not affect much during Covid, and steadily rises until December 2024. While EBITDA margins are fluctuative, EBITDA is considered stable around $1-$2 B.

Offshore Drilling Companies

Transocean LTD (NYSE:RIG)

Transocean is the last true pure-play offshore drilling contractor, operating one of the most advanced fleets of ultra-deepwater and harsh-environment floaters in the world. With U.S. offshore leasing revived under EO 14154, $RIG is well-positioned to benefit from a tightening rig market, rising day rates, and longer-term contracts.

Source: Morningstar, latest earnings

The company’s client base includes major IOCs, NOCs, and independents, and its business model is backed by a $9.2 billion backlog, offering rare visibility in a cyclical sector.

Critically, Transocean owns the highest-specification fleet in the industry, dominating the market for:

100% of the 1700 ST-rated rigs

67% of 1400 ST rigs

29% of high-spec harsh-environment semis

This high-spec positioning allows Transocean to command premium day rates and secure contracts in the most technically demanding offshore fields globally. Transocean is a high-beta, asset-heavy bet on a global offshore drilling comeback, with direct upside from federal policy shifts and long-cycle E&P investment.

Despite upstream investment remaining flat for next three years, deepwater investment is set to grow from up to 16%. This aligns with the rising Day Rate from 2021 to 2024, a sign of rising demand in deepwater drilling.

Rising Charter Rates finally impact RIG's profitability. Revenue rose from $700 M to $900 M, followed by EBITDA leaving under $200 M level and rebound above $ 300 M, and EBITDA Margin spiking from 20% to 35.7%.

Special Mention - Direct EOs Players:

Alaskan King: ConocoPhillips (NYSE: COP)

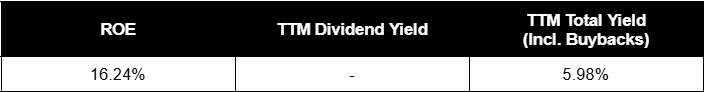

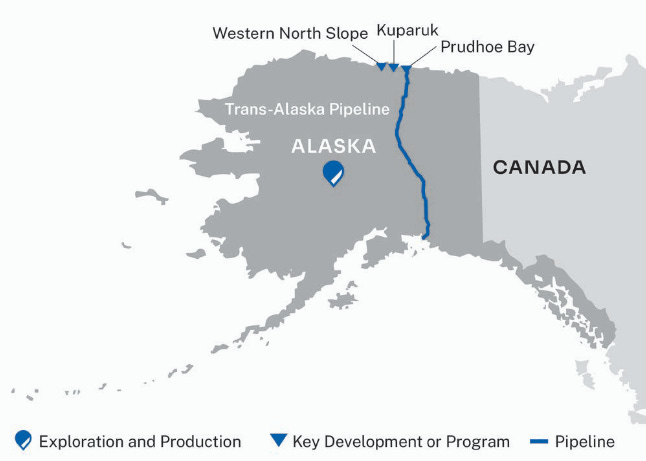

ConocoPhillips is one of the world’s largest independent E&P companies, and the largest operator in Alaska, with proven reserves of ~1.5 billion barrels of oil equivalent (BBOE). Approximately 75% of its Alaskan portfolio is undrilled, providing significant long-term upside, especially if Arctic drilling is accelerated under favorable policy (EO 1453). $COP also holds joint ventures with $XOM, $CVX, and $SHEL across major U.S. shale and global projects.

Source: Morningstar, latest earnings

The company operates across Alaska’s key regions:

Prudhoe Bay: North America’s largest conventional oil field, with ongoing waterflood and EOR operations. Net production averaged ~88 Million Barrels of Oil Equivalent per Day (MBOED).

Kuparuk & Nuna: Active drilling in multiple satellite fields; first oil from the Nuna project achieved in late 2024. Net production averaged ~63 MBOED

Western North Slope: Seasonal and full-time rigs running in the Colville and Greater Mooses Tooth Units. Net production averaged ~43 MBOED

Alaska Regions have production capacity of 194 Million Barrels of Oil Equivalent per Day, and 1.5 Billion Barrel of Oil Equivalent Reserves. Conocco has been committed to Alaska for more than 50 years. Any support to this region will definitely brighten their outlook

Beyond Alaska, ConocoPhillips has a globally diversified portfolio, including:

U.S. shale (Permian, Eagle Ford)

LNG assets in Asia-Pacific

Oil sands in Canada

Operations in the North Sea, Middle East, and Southeast Asia

Its integrated scale, exploration depth, and policy-aligned Arctic position make it one of the best long-term upside plays in a fossil-fuel-forward environment.

After the Covid-19, COP performance quickly rebounded and they managed to have stable revenue above $10 B, and EBITDA hovering around $5-$10 B, and an EBITDA margin strong above 40%.

LNG King: Cheniere Energy Inc (NYSE: LNG)

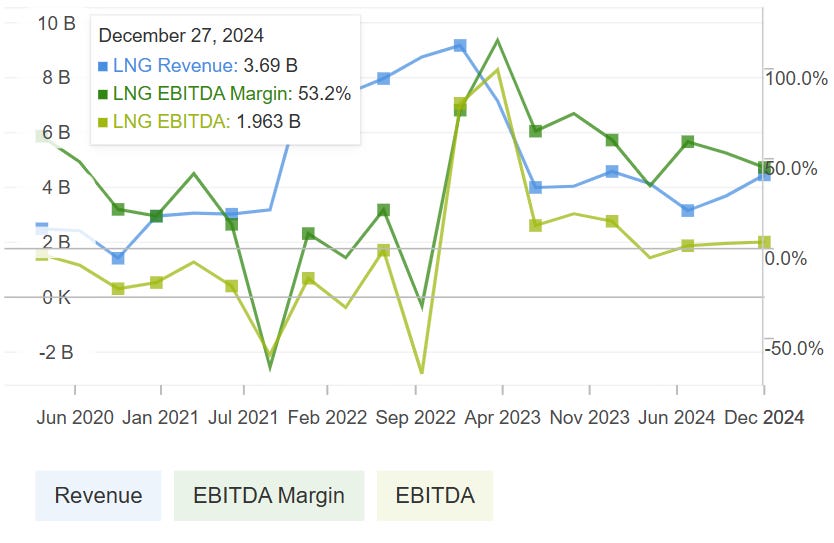

Cheniere is the largest LNG exporter in the United States, with two core terminals, Sabine Pass and Corpus Christi, totaling ~45 MTPA export capacity. It signed long-term (20+ year) offtake agreements with Asian and European buyers, locking in stable cash flows. Following Trump’s EO 14156 and 14154, LNG infrastructure is being deregulated and fast-tracked, unlocking upside from additional liquefaction trains (+10 MTPA expansion).

As the #1 LNG producer and #2 largest LNG operator globally, Cheniere delivers to 43 markets and regions worldwide. Europe and Asia contribute the most to LNG exports. European imports have risen and reached record highs, driven by efforts to refill storage, as EU gas storage levels remain below the five-year average. China’s LNG imports are also expected to remain stable, accounting for approximately 25% of the gas supply mix through 2040 (estimated). LNG maintains a strategic advantage in both markets.

Source: Morningstar, latest earnings

Backed by long-term offtake contracts (20+ years) with Asian and European buyers, Cheniere enjoys stable, predictable cash flows. It also owns and operates the Creole Trail and Corpus Christi pipelines, which connect its LNG terminals to the U.S. natural gas grid.

The company is a clear beneficiary of EO 14156 and EO 14154, which streamline LNG infrastructure permitting and support U.S. energy exports as a geopolitical tool. As global demand for LNG rises amid continued supply disruptions, Cheniere stands at the intersection of U.S. energy policy and global gas security.

Navigate The Tide: Use ETF As Your Radar

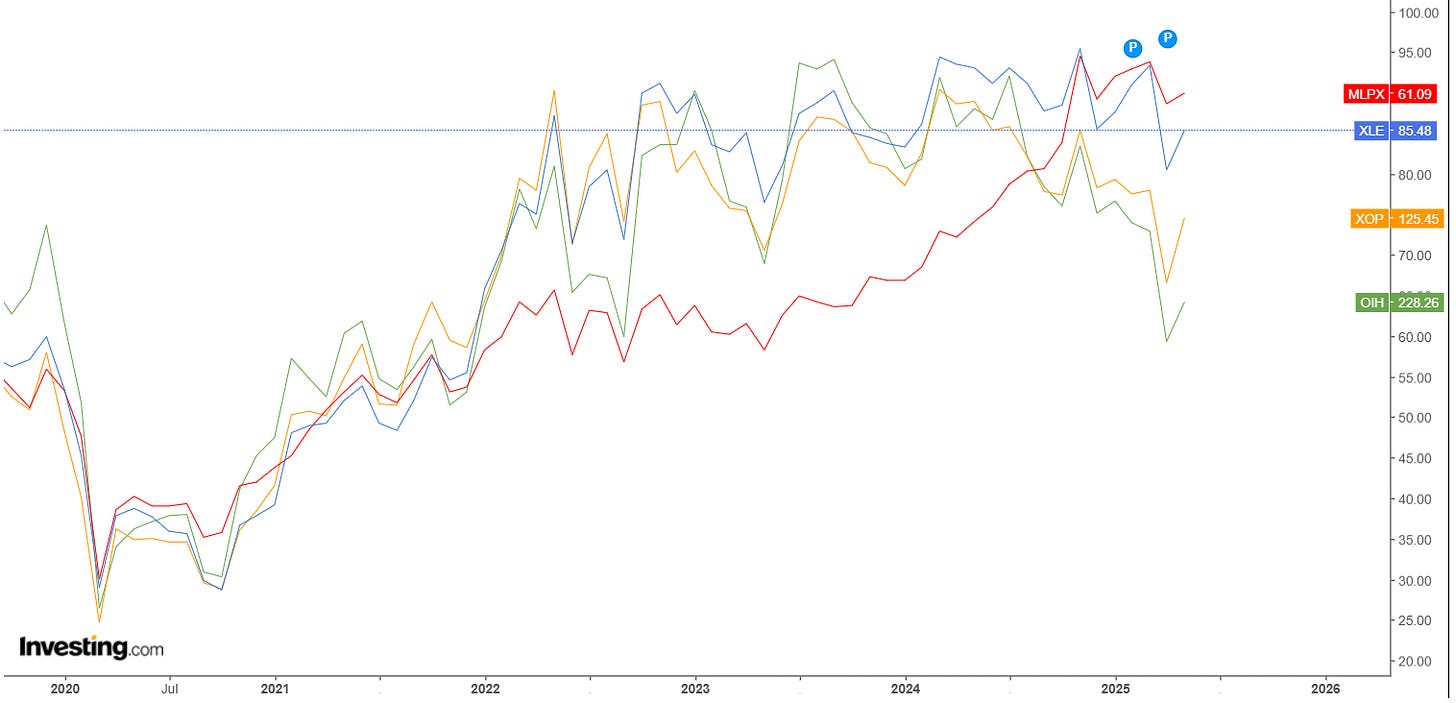

While we are talking about the long-run, investors still could ride the short-term wave. Instead of doing a deep dive on each of the companies, ETF could save you a lot of time. ETF price movements can serve as a real-time barometer of sector momentum.

Exchange-Traded Funds (ETFs) group similar companies together , whether they focus on oil production, drilling services, or energy infrastructure. By observing how these ETFs move, investors and analysts can gauge market sentiment, capital rotation, and relative strength across different segments of the energy value chain.

For example, a sharp upward move in OIH (oilfield services ETF) could signal renewed investor confidence in offshore drilling and exploration. A breakout in MLPX may indicate growing optimism around LNG exports and midstream infrastructure. Meanwhile, XOP tends to react quickly to changes in oil prices, reflecting speculative momentum in shale E&P stocks.

By monitoring ETF trends over days, weeks, or quarters, analysts can detect sector inflection points , when capital starts flowing in or out of a specific energy niche , and get early signals before earnings or policy headlines catch up.

ETFs, in this sense, are not just passive investment products. They’re real-time momentum trackers that reflect how the market is pricing the future of fossil fuels , faster than fundamentals alone.

By monitoring these ETFs, you as an investor can:

Gauge rotation into or out of energy as a macro theme

Validate bottoms or breakouts in services (OIH) or shale (XOP)

Compare performance between upstream, midstream, and support stocks

Capture macro exposure if stock-picking conviction is low

For instance, If you believe EO 14154 will boost offshore activity but aren't sure whether to buy Transocean ($RIG) or Tidewater ($TDW), track OIH , it gives you broad exposure to oil services with less company-specific risk. Likewise, if LNG terminals are getting fast-tracked under EO 14156, ETFs like MLPX let you ride the infrastructure wave that benefits players like Cheniere ($LNG) and Energy Transfer ($ET).

Final Thought

After three articles, we’ve explored the policy shifts, structural imbalances, and strategic winners within America’s evolving energy playbook. From Arctic drilling to offshore expansion and LNG exports, these executive orders do more than just set direction. They redefine where capital flows and how value is captured across the energy chain. The data shows us which segments are exposed to volatility, and which ones are built to endure. Offshore services, OSVs, and drillers may not chase price spikes, but they offer something rarer: resilience.

Because in the end, not all energy exposure moves the same. Some names trade on momentum. Others are locked into long-term contracts and continue to grow quietly as the world shifts. The next move doesn’t have to be bold or obvious. But when policy has already made its statement, the question is whether the market has started to respond.